Rising Awareness of Environmental Impact

Awareness of the environmental impact of refrigerants is driving the Global Low GWP Refrigerants Market Industry. As climate change becomes a pressing global issue, stakeholders are increasingly recognizing the importance of sustainable practices in refrigeration. This heightened awareness is prompting manufacturers, consumers, and policymakers to prioritize low GWP alternatives. Educational campaigns and industry initiatives are further amplifying this awareness, leading to a shift in consumer preferences towards eco-friendly refrigerants. Consequently, the market is expected to experience substantial growth as more entities commit to reducing their carbon footprint and embracing low GWP solutions.

Market Dynamics and Competitive Landscape

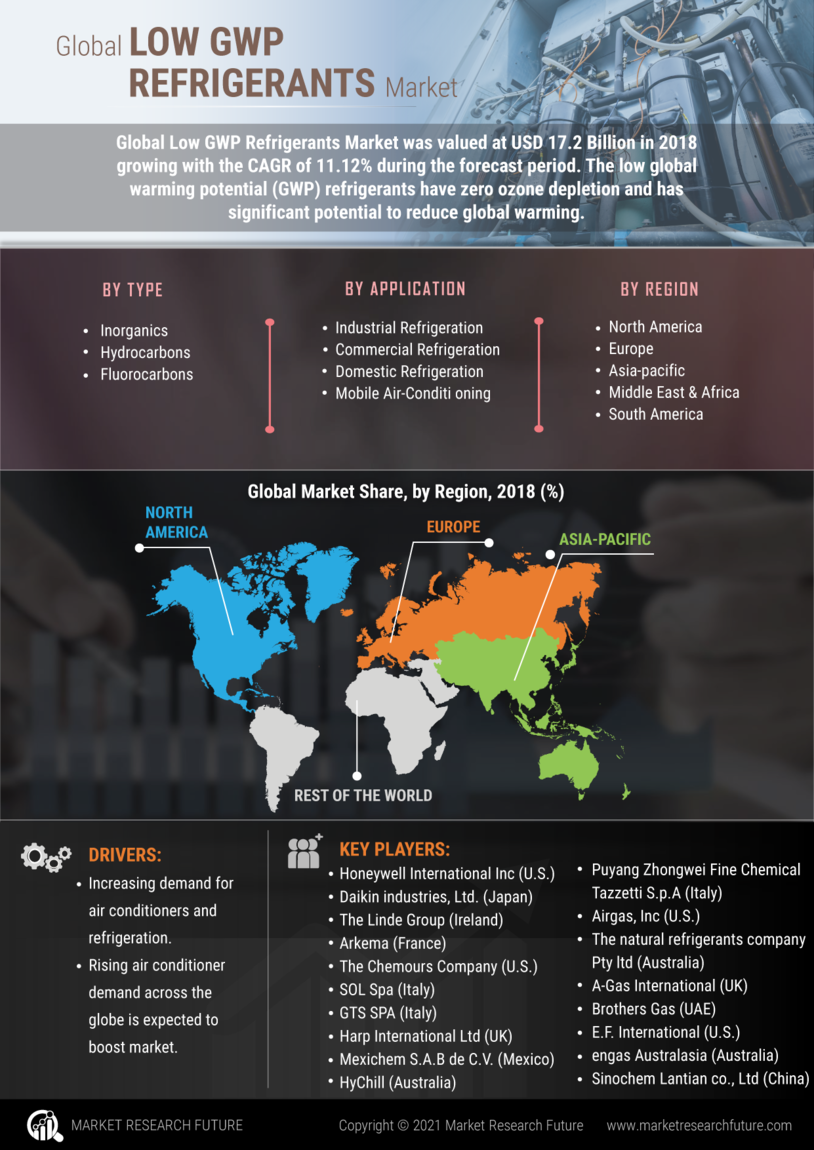

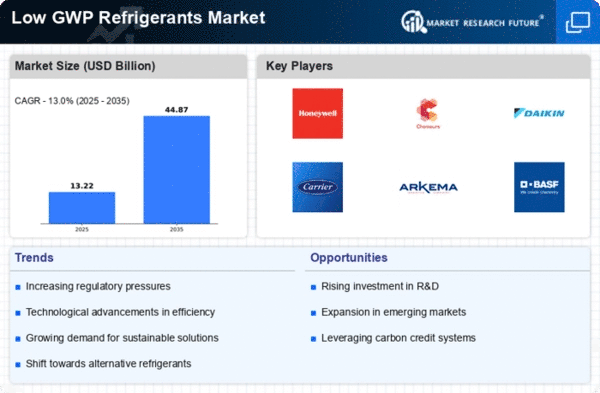

The competitive landscape of the Global Low GWP Refrigerants Market Industry is characterized by dynamic market forces that influence pricing, innovation, and product offerings. Key players are actively investing in research and development to create advanced low GWP refrigerants that meet evolving regulatory standards and consumer demands. This competitive environment fosters innovation and drives down costs, making low GWP options more accessible. As companies strive to differentiate themselves, the market is likely to witness an influx of new products and technologies, further propelling growth in the sector.

Regulatory Support for Low GWP Refrigerants

The Global Low GWP Refrigerants Market Industry benefits from increasing regulatory support aimed at reducing greenhouse gas emissions. Governments worldwide are implementing stringent regulations to phase out high global warming potential refrigerants, such as hydrofluorocarbons (HFCs). For instance, the Kigali Amendment to the Montreal Protocol mandates a gradual reduction in HFC consumption, which is expected to drive the adoption of low GWP alternatives. This regulatory landscape is anticipated to propel the market, with projections indicating a market value of 43.2 USD Billion in 2024, reflecting the urgency for environmentally friendly refrigerants.

Technological Advancements in Refrigeration

Technological innovation plays a pivotal role in the Global Low GWP Refrigerants Market Industry. Advances in refrigeration technology, such as the development of new low GWP refrigerants and improved system efficiencies, are facilitating the transition from traditional refrigerants. For example, the introduction of hydrocarbon-based refrigerants has shown promising results in energy efficiency and environmental impact. These advancements not only enhance performance but also align with regulatory requirements, thereby fostering market growth. As the industry evolves, the market is projected to reach 124.9 USD Billion by 2035, indicating a robust demand for innovative solutions.

Growing Demand for Energy-Efficient Solutions

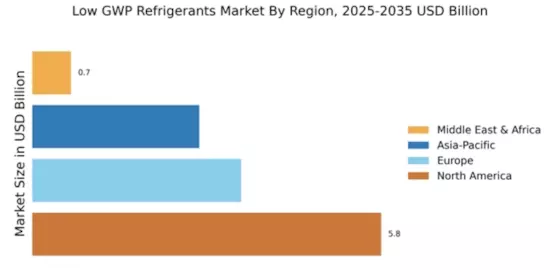

The increasing emphasis on energy efficiency is a significant driver for the Global Low GWP Refrigerants Market Industry. As energy costs rise and environmental concerns mount, consumers and businesses are seeking refrigeration solutions that minimize energy consumption. Low GWP refrigerants often exhibit superior energy efficiency compared to their high GWP counterparts, making them an attractive option. This trend is reflected in the market's projected compound annual growth rate of 10.13% from 2025 to 2035. The shift towards energy-efficient systems is likely to accelerate the adoption of low GWP refrigerants across various sectors, including commercial refrigeration and air conditioning.