Increasing Energy Density Requirements

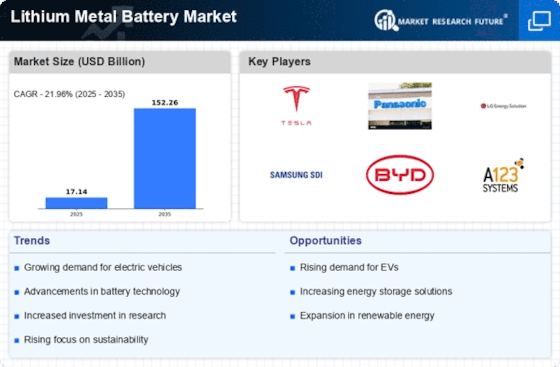

The Lithium Metal Battery Market is experiencing a surge in demand driven by the increasing energy density requirements across various applications. As industries seek to enhance the performance of electric vehicles and portable electronics, the need for batteries that can store more energy in a smaller footprint becomes paramount. Lithium metal batteries, with their potential to deliver higher energy densities compared to traditional lithium-ion batteries, are well-positioned to meet these demands. Recent studies indicate that lithium metal batteries can achieve energy densities exceeding 300 Wh/kg, which is significantly higher than conventional alternatives. This capability not only supports longer-lasting devices but also aligns with the growing consumer preference for lightweight and efficient energy solutions.

Rising Demand for Consumer Electronics

The Lithium Metal Battery Market is witnessing a notable increase in demand driven by the consumer electronics sector. With the proliferation of smart devices, wearables, and portable gadgets, manufacturers are seeking batteries that offer longer life and faster charging times. Lithium metal batteries, known for their superior energy density and lightweight characteristics, are becoming increasingly attractive to electronics manufacturers. Market analysis suggests that the consumer electronics segment is expected to account for a substantial share of the lithium battery market, potentially exceeding USD 50 billion by 2025. This trend underscores the importance of lithium metal batteries in meeting the evolving needs of tech-savvy consumers.

Growing Investment in Renewable Energy Storage

The Lithium Metal Battery Market is benefiting from the growing investment in renewable energy storage solutions. As the world shifts towards sustainable energy sources, the need for efficient energy storage systems becomes increasingly critical. Lithium metal batteries, with their high energy density and rapid charging capabilities, are emerging as a viable option for storing energy generated from renewable sources such as solar and wind. Recent projections suggest that the energy storage market could reach USD 200 billion by 2025, with lithium-based technologies playing a pivotal role. This trend indicates a robust future for lithium metal batteries as they become integral to the energy transition.

Supportive Government Policies and Regulations

Supportive government policies and regulations are playing a crucial role in shaping the Lithium Metal Battery Market. Many governments are implementing initiatives aimed at promoting electric vehicles and renewable energy technologies, which in turn drives the demand for advanced battery solutions. Incentives such as tax credits, subsidies, and research grants are encouraging manufacturers to invest in lithium metal battery technologies. Furthermore, regulatory frameworks aimed at reducing carbon emissions are likely to bolster the adoption of lithium metal batteries in various sectors. As these policies continue to evolve, they are expected to create a favorable environment for the growth of the lithium metal battery market.

Technological Innovations in Battery Manufacturing

Technological advancements in battery manufacturing processes are propelling the Lithium Metal Battery Market forward. Innovations such as solid-state battery technology and improved electrolyte formulations are enhancing the safety and efficiency of lithium metal batteries. These advancements are crucial as they address previous concerns regarding dendrite formation, which can lead to short circuits and battery failure. The introduction of new manufacturing techniques is expected to reduce production costs and improve scalability, making lithium metal batteries more accessible to a broader range of applications. As a result, the market is likely to witness a significant increase in adoption rates, particularly in sectors such as automotive and consumer electronics.