Government Policies and Regulations

Government policies and regulations aimed at promoting clean energy and reducing carbon emissions are significantly influencing the Lithium Ion Cell Battery Pack Market. Many countries are implementing stringent regulations that encourage the adoption of electric vehicles and renewable energy solutions. For instance, various governments have set ambitious targets for phasing out internal combustion engines, which is expected to drive the demand for lithium-ion batteries. In 2025, it is projected that regulatory frameworks will further support the growth of the Lithium Ion Cell Battery Pack Market, as incentives for battery production and recycling initiatives become more prevalent, fostering a sustainable ecosystem for battery technology.

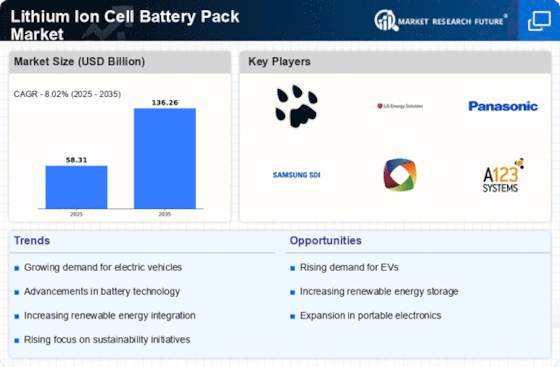

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium Ion Cell Battery Pack Market. As consumers and manufacturers alike prioritize sustainability, the shift towards EVs has accelerated. In 2025, the demand for lithium-ion batteries in the automotive sector is projected to reach approximately 1,200 GWh, reflecting a compound annual growth rate of around 25%. This surge is largely attributed to government incentives and consumer preferences for eco-friendly transportation options. Consequently, the Lithium Ion Cell Battery Pack Market is experiencing significant growth, as manufacturers strive to meet the escalating demand for high-performance battery packs that can support longer ranges and faster charging times.

Increased Consumer Electronics Usage

The proliferation of consumer electronics is a significant driver for the Lithium Ion Cell Battery Pack Market. With the rise of smartphones, laptops, and wearable devices, the demand for compact and efficient battery packs has surged. In 2025, the consumer electronics segment is anticipated to account for over 40% of the total lithium-ion battery demand, reflecting a strong correlation between technological advancements and consumer preferences. As manufacturers seek to produce lighter and longer-lasting devices, the Lithium Ion Cell Battery Pack Market is likely to benefit from innovations that enhance battery life and reduce charging times, thereby meeting the expectations of tech-savvy consumers.

Growth in Renewable Energy Storage Solutions

The increasing integration of renewable energy sources, such as solar and wind, is driving the demand for energy storage solutions, thereby benefiting the Lithium Ion Cell Battery Pack Market. As countries strive to meet renewable energy targets, the need for efficient energy storage systems becomes paramount. In 2025, the market for lithium-ion batteries in energy storage applications is expected to exceed 300 GWh, indicating a robust growth trajectory. This trend is fueled by the necessity for grid stability and the ability to store excess energy generated during peak production times. Consequently, the Lithium Ion Cell Battery Pack Market is positioned to capitalize on this growing demand for reliable and scalable energy storage solutions.

Technological Innovations in Battery Technology

Technological advancements in battery technology are propelling the Lithium Ion Cell Battery Pack Market forward. Innovations such as solid-state batteries and enhanced energy density are being developed to improve performance and safety. For instance, the energy density of lithium-ion batteries has improved by nearly 30% over the past few years, allowing for lighter and more efficient battery packs. These advancements not only enhance the performance of electric vehicles but also expand the applications of lithium-ion batteries in consumer electronics and renewable energy storage. As research and development continue to evolve, the Lithium Ion Cell Battery Pack Market is likely to witness further enhancements that could redefine energy storage solutions.