Increased Consumer Awareness

Consumer awareness regarding environmental issues and the benefits of lithium-ion technology is driving the Lithium Ion Battery Binders Market. As individuals become more informed about the advantages of electric vehicles and renewable energy storage, the demand for efficient battery solutions is likely to increase. This heightened awareness is prompting manufacturers to focus on producing high-performance batteries that utilize advanced binders. In 2025, it is estimated that consumer demand for sustainable products will continue to rise, further influencing the Lithium Ion Battery Binders Market. Consequently, manufacturers are expected to prioritize the development of innovative binder solutions that align with consumer preferences.

Growing Renewable Energy Sector

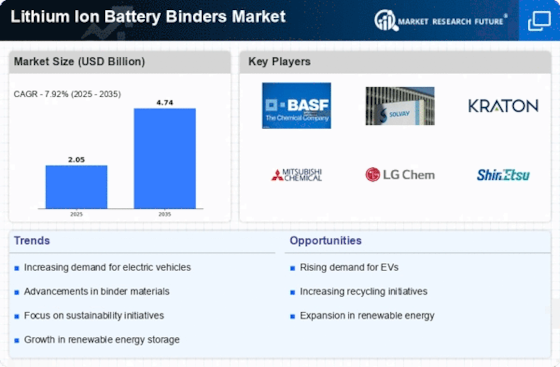

The expansion of the renewable energy sector is another significant driver for the Lithium Ion Battery Binders Market. As the world shifts towards cleaner energy sources, the demand for energy storage solutions has intensified. Lithium-ion batteries are pivotal in storing energy generated from renewable sources such as solar and wind. In 2025, the energy storage market is anticipated to grow substantially, with lithium-ion batteries accounting for a significant share. This growth necessitates the development of efficient binders that can enhance the performance and reliability of these batteries. Therefore, the Lithium Ion Battery Binders Market is likely to benefit from the increasing investments in renewable energy infrastructure.

Advancements in Battery Technology

Technological advancements in battery chemistry and design are significantly impacting the Lithium Ion Battery Binders Market. Innovations such as solid-state batteries and enhanced lithium-ion formulations are driving the need for specialized binders that can accommodate new materials and improve overall battery efficiency. The market for lithium-ion batteries is expected to reach a valuation of over 100 billion dollars by 2026, indicating a robust growth trajectory. As manufacturers strive to enhance energy density and reduce charging times, the role of binders becomes increasingly critical. This trend suggests that the Lithium Ion Battery Binders Market will continue to evolve in tandem with these technological advancements, creating opportunities for new product development.

Regulatory Support for Clean Energy

Regulatory frameworks promoting clean energy and emissions reduction are influencing the Lithium Ion Battery Binders Market. Governments worldwide are implementing policies that encourage the adoption of electric vehicles and renewable energy solutions. These regulations often include incentives for battery manufacturers to develop more efficient and sustainable products. As a result, the demand for high-quality lithium-ion batteries, and consequently the binders used in their production, is expected to rise. The regulatory environment is likely to create a favorable landscape for the Lithium Ion Battery Binders Market, driving innovation and investment in binder technologies.

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium Ion Battery Binders Market. As consumers and manufacturers alike prioritize sustainable transportation solutions, the demand for high-performance lithium-ion batteries has surged. In 2025, the EV market is projected to grow at a compound annual growth rate of approximately 20%, necessitating advanced battery technologies. This growth directly influences the demand for effective binders that enhance battery performance and longevity. Consequently, manufacturers are compelled to innovate and improve binder formulations to meet the evolving requirements of the automotive sector, thereby propelling the Lithium Ion Battery Binders Market forward.