Regulatory and Compliance Pressures

Regulatory frameworks aimed at promoting energy efficiency are exerting pressure on industries to adopt advanced energy measurement solutions, thereby impacting the Energy Measurement ICs Market. Governments worldwide are implementing stringent regulations that mandate accurate energy monitoring and reporting. This regulatory landscape is compelling organizations to invest in energy measurement ICs to ensure compliance and avoid penalties. The increasing focus on sustainability and carbon footprint reduction is likely to further drive the demand for energy measurement solutions. As industries adapt to these regulatory requirements, the Energy Measurement ICs Market is expected to experience growth, as companies seek to enhance their energy measurement capabilities.

Advancements in Smart Metering Technologies

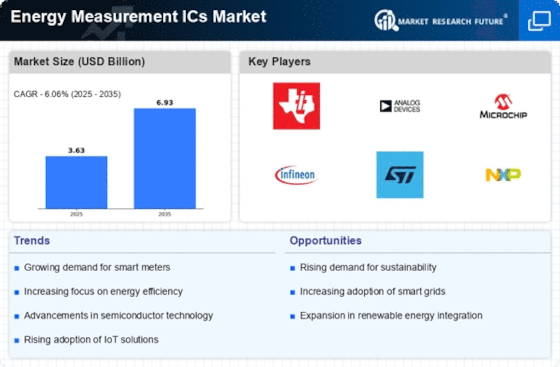

The evolution of smart metering technologies is a pivotal driver for the Energy Measurement ICs Market. Smart meters, which provide real-time data on energy consumption, are increasingly being adopted by utility companies to enhance operational efficiency. The Energy Measurement ICs Market is expected to witness substantial growth, with projections indicating a compound annual growth rate of over 10% in the coming years. This surge in smart metering adoption necessitates sophisticated energy measurement ICs that can accurately capture and transmit data. As utilities seek to improve customer engagement and optimize energy distribution, the demand for advanced energy measurement solutions is likely to escalate, thereby benefiting the Energy Measurement ICs Market.

Increased Focus on Energy Management Systems

The growing emphasis on energy management systems (EMS) is significantly influencing the Energy Measurement ICs Market. Organizations are increasingly recognizing the importance of energy efficiency and sustainability, leading to the implementation of EMS to monitor and control energy usage. The market for energy management systems is projected to expand, with a notable increase in investments aimed at reducing operational costs and enhancing energy efficiency. Energy measurement ICs play a critical role in these systems, providing the necessary data for informed decision-making. As businesses strive to achieve energy savings and comply with regulatory standards, the demand for energy measurement ICs is expected to rise, further propelling the Energy Measurement ICs Market.

Rising Demand for Renewable Energy Solutions

The increasing emphasis on renewable energy sources is driving the Energy Measurement ICs Market. As nations strive to meet sustainability goals, the integration of energy measurement integrated circuits becomes crucial for monitoring and optimizing energy consumption. The market for renewable energy is projected to grow significantly, with investments in solar and wind energy systems requiring precise energy measurement solutions. This trend indicates a robust demand for energy measurement ICs, as they facilitate the efficient management of energy resources, ensuring that renewable energy systems operate at peak efficiency. Furthermore, the transition to renewable energy necessitates advanced measurement technologies, which could potentially enhance the overall performance of energy systems, thereby propelling the Energy Measurement ICs Market forward.

Technological Innovations in Energy Measurement

Technological advancements in energy measurement are reshaping the Energy Measurement ICs Market. Innovations such as enhanced accuracy, miniaturization, and integration with IoT devices are driving the development of next-generation energy measurement ICs. These advancements enable more precise monitoring of energy consumption, which is essential for both residential and industrial applications. The market for energy measurement ICs is likely to benefit from these innovations, as they provide solutions that meet the evolving needs of consumers and businesses alike. Furthermore, the integration of energy measurement ICs with smart technologies could lead to improved energy management practices, thereby fostering growth within the Energy Measurement ICs Market.