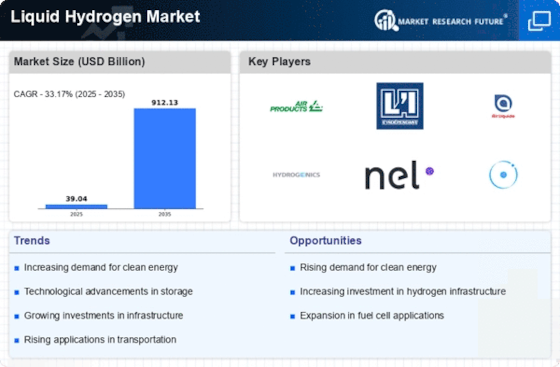

Rising Demand for Clean Energy

The increasing The Liquid Hydrogen Industry. As nations strive to meet carbon neutrality goals, hydrogen emerges as a viable alternative to fossil fuels. The International Energy Agency indicates that hydrogen could account for up to 18% of the world's energy demand by 2050. This shift is particularly evident in sectors such as transportation and industrial processes, where hydrogen is being adopted to reduce greenhouse gas emissions. The Liquid Hydrogen Market is poised to benefit from this trend, as industries seek sustainable energy sources to comply with stringent environmental regulations. Furthermore, investments in hydrogen infrastructure are expected to rise, facilitating the growth of the Liquid Hydrogen Market and enhancing its role in the global energy landscape.

Government Incentives and Support

Government policies and incentives play a crucial role in shaping the Liquid Hydrogen Market. Many countries are implementing subsidies and tax incentives to promote hydrogen production and utilization. For instance, the European Union has allocated substantial funding to support hydrogen projects as part of its Green Deal initiative. This financial backing is expected to accelerate the development of hydrogen infrastructure and technologies, thereby boosting the Liquid Hydrogen Market. Additionally, regulatory frameworks that favor hydrogen adoption are likely to emerge, creating a conducive environment for investment and innovation. As governments prioritize clean energy solutions, the Liquid Hydrogen Market stands to gain from increased public and private sector collaboration.

Increased Focus on Energy Security

Energy security concerns are driving interest in the Liquid Hydrogen Market as countries seek to diversify their energy sources. The volatility of fossil fuel markets has prompted nations to explore alternative energy solutions, including hydrogen. Liquid hydrogen offers a strategic advantage due to its potential for long-term storage and transportability. As countries aim to reduce dependence on imported fuels, the Liquid Hydrogen Market is likely to experience heightened demand. Furthermore, the development of hydrogen as a key component in energy storage systems could enhance grid stability and resilience. This focus on energy security may lead to increased investments in hydrogen infrastructure, further propelling the growth of the Liquid Hydrogen Market.

Growing Applications in Transportation

The transportation sector is increasingly recognizing the potential of liquid hydrogen as a clean fuel alternative, driving growth in the Liquid Hydrogen Market. Hydrogen fuel cell vehicles are gaining traction due to their zero-emission capabilities and longer ranges compared to battery electric vehicles. Major automotive manufacturers are investing heavily in hydrogen technology, with projections suggesting that the number of hydrogen fuel cell vehicles could reach several million units by 2030. This surge in demand for hydrogen-powered transportation solutions is likely to create new opportunities within the Liquid Hydrogen Market, as infrastructure for refueling stations expands to accommodate this shift. The integration of liquid hydrogen in public transport systems further underscores its potential as a sustainable energy source.

Advancements in Hydrogen Production Technologies

Technological advancements in hydrogen production methods are significantly influencing the Liquid Hydrogen Market. Innovations such as electrolysis and steam methane reforming are becoming more efficient and cost-effective, thereby increasing the feasibility of hydrogen as a mainstream energy source. According to recent data, the cost of producing hydrogen through electrolysis has decreased by approximately 50% over the past decade. This reduction in production costs is likely to stimulate demand for liquid hydrogen, particularly in sectors that require high-purity hydrogen. As production technologies continue to evolve, the Liquid Hydrogen Market may witness enhanced scalability and accessibility, further solidifying hydrogen's position in the energy sector.