Regulatory Framework and Incentives

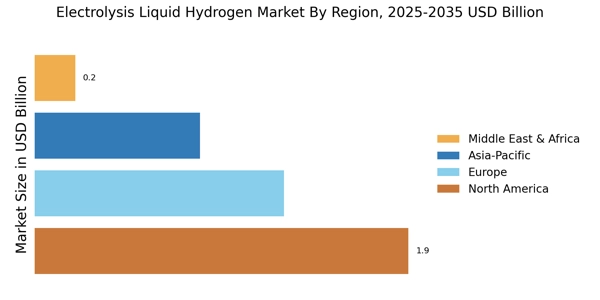

The Electrolysis Liquid Hydrogen Market is significantly influenced by supportive regulatory frameworks and incentives aimed at promoting clean energy solutions. Governments across various regions are implementing policies that encourage the adoption of hydrogen technologies, including tax credits, grants, and subsidies for research and development. For example, certain countries have set ambitious targets for hydrogen production, aiming for a substantial increase in capacity by 2030. This regulatory support not only fosters innovation but also creates a favorable investment climate for stakeholders in the Electrolysis Liquid Hydrogen Market. Furthermore, international agreements focused on reducing carbon emissions are likely to bolster the demand for hydrogen as a clean energy carrier, thereby enhancing market growth prospects.

Rising Energy Costs and Energy Security

The Electrolysis Liquid Hydrogen Market is being driven by rising energy costs and the increasing need for energy security. As traditional energy sources become more volatile and expensive, there is a growing interest in alternative energy solutions, including hydrogen produced through electrolysis. The ability of hydrogen to serve as a stable energy carrier can mitigate risks associated with energy supply disruptions. Moreover, the transition towards hydrogen is seen as a strategic move to diversify energy portfolios and enhance resilience against geopolitical tensions. Market data indicates that the demand for hydrogen is projected to grow significantly, with estimates suggesting a potential market size of over USD 200 billion by 2030. This trend underscores the importance of hydrogen in achieving energy independence and sustainability, further propelling the Electrolysis Liquid Hydrogen Market.

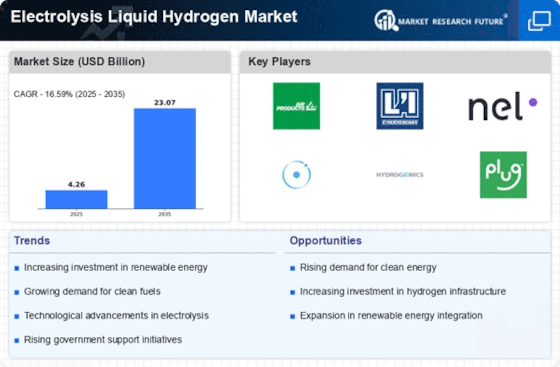

Increasing Investment in Renewable Energy

The Electrolysis Liquid Hydrogen Market is benefiting from the increasing investment in renewable energy sources. As the world shifts towards sustainable energy solutions, investments in solar, wind, and hydroelectric power are on the rise. These renewable sources are crucial for powering electrolysis processes, which produce hydrogen without carbon emissions. Recent reports indicate that investments in renewable energy technologies have reached unprecedented levels, with billions allocated to projects that integrate electrolysis for hydrogen production. This influx of capital not only supports the development of more efficient electrolysis systems but also enhances the overall viability of hydrogen as a clean energy source. Consequently, the synergy between renewable energy investments and the Electrolysis Liquid Hydrogen Market is likely to drive substantial growth in the coming years.

Technological Innovations in Electrolysis

The Electrolysis Liquid Hydrogen Market is experiencing a surge in technological innovations that enhance the efficiency and cost-effectiveness of hydrogen production. Advanced electrolysis technologies, such as proton exchange membrane (PEM) and alkaline electrolysis, are being developed to optimize energy consumption and increase hydrogen yield. For instance, recent advancements have demonstrated the potential to reduce the energy input required for hydrogen production by up to 30%. This not only lowers operational costs but also makes hydrogen a more viable alternative to fossil fuels. As these technologies mature, they are likely to attract significant investments, further propelling the growth of the Electrolysis Liquid Hydrogen Market. The integration of renewable energy sources, such as solar and wind, into electrolysis processes is also expected to enhance sustainability, making hydrogen production more environmentally friendly.

Growing Industrial Applications of Hydrogen

The Electrolysis Liquid Hydrogen Market is witnessing a growing demand for hydrogen across various industrial applications. Industries such as transportation, chemicals, and metallurgy are increasingly recognizing hydrogen's potential as a clean energy source and feedstock. For instance, hydrogen is being utilized in fuel cells for zero-emission vehicles, which is expected to see a compound annual growth rate of over 20% in the next decade. Additionally, hydrogen is essential in the production of ammonia and methanol, which are critical for fertilizers and chemicals. The expanding use of hydrogen in these sectors is likely to create new opportunities for the Electrolysis Liquid Hydrogen Market, as companies seek to reduce their carbon footprints and comply with stringent environmental regulations. This trend indicates a robust future for hydrogen as a key player in the transition to a sustainable economy.