Rising Demand for Renewable Energy

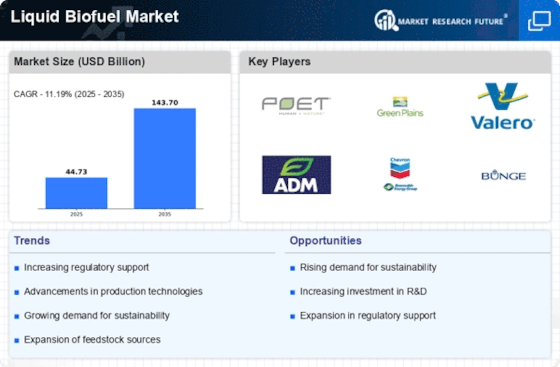

The increasing The Liquid Biofuel Industry. As nations strive to reduce greenhouse gas emissions and combat climate change, the demand for cleaner energy alternatives has surged. According to recent data, the biofuel sector is projected to grow at a compound annual growth rate of approximately 8% over the next decade. This growth is largely attributed to the transition from fossil fuels to renewable sources, with liquid biofuels playing a crucial role in this shift. The Liquid Biofuel Market is thus positioned to benefit from this rising demand, as consumers and industries alike seek sustainable energy solutions that align with environmental goals.

Government Policies and Regulations

Government policies and regulations significantly influence the Liquid Biofuel Market. Many countries have implemented mandates and incentives to promote the use of biofuels, aiming to enhance energy security and reduce reliance on fossil fuels. For instance, several nations have set ambitious targets for biofuel blending in transportation fuels, which has led to an increase in production capacities. The implementation of tax credits and subsidies for biofuel producers further stimulates market growth. As of 2025, it is estimated that regulatory frameworks will continue to evolve, potentially leading to a more favorable environment for the Liquid Biofuel Market, thereby encouraging investment and innovation.

Consumer Preference for Sustainable Products

Consumer preferences are shifting towards sustainable products, which is positively impacting the Liquid Biofuel Market. As awareness of environmental issues grows, consumers are increasingly seeking energy solutions that align with their values. This trend is reflected in the rising demand for biofuels, which are perceived as more sustainable alternatives to conventional fossil fuels. Market data suggests that a significant portion of consumers is willing to pay a premium for products that contribute to environmental sustainability. Consequently, the Liquid Biofuel Market is likely to benefit from this consumer shift, as businesses adapt their offerings to meet the demand for greener energy solutions.

Growing Investment in Biofuel Infrastructure

Investment in biofuel infrastructure is a critical driver for the Liquid Biofuel Market. The establishment of production facilities, distribution networks, and refueling stations is essential for the widespread adoption of biofuels. Recent reports indicate that investments in biofuel infrastructure have increased significantly, with several countries allocating funds to enhance their biofuel supply chains. This investment not only supports the growth of the Liquid Biofuel Market but also facilitates the integration of biofuels into existing energy systems. As infrastructure continues to develop, it is anticipated that the accessibility and availability of biofuels will improve, further driving market expansion.

Technological Innovations in Biofuel Production

Technological advancements in biofuel production processes are driving the Liquid Biofuel Market forward. Innovations such as improved fermentation techniques and the development of advanced feedstocks have enhanced the efficiency and cost-effectiveness of biofuel production. For example, the introduction of second and third-generation biofuels, derived from non-food biomass, has expanded the potential feedstock base, reducing competition with food supplies. As production technologies continue to evolve, the Liquid Biofuel Market is likely to witness increased output and reduced production costs, making biofuels more competitive against traditional fossil fuels. This trend may lead to a broader adoption of biofuels across various sectors.