Sustainability Focus

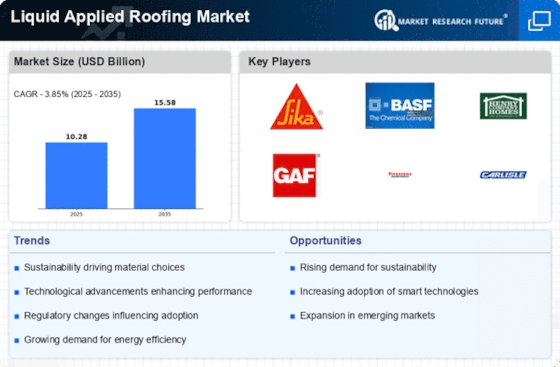

The increasing emphasis on sustainability within the construction sector appears to be a pivotal driver for the Liquid Applied Roofing Market. As environmental regulations tighten and consumers become more eco-conscious, the demand for roofing solutions that minimize environmental impact is likely to rise. Liquid applied roofing systems, often composed of eco-friendly materials, offer a sustainable alternative to traditional roofing methods. This shift is evidenced by a growing number of projects seeking LEED certification, which often favors the use of sustainable materials. Furthermore, the market for sustainable roofing solutions is projected to expand, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend indicates a robust opportunity for manufacturers and contractors within the Liquid Applied Roofing Market to align their offerings with sustainability goals.

Regulatory Compliance

Regulatory compliance is increasingly becoming a critical driver for the Liquid Applied Roofing Market. Governments and local authorities are implementing stricter building codes and standards aimed at improving energy efficiency and safety in construction. Liquid applied roofing systems, which often meet or exceed these regulatory requirements, are thus gaining favor among builders and contractors. Compliance with energy efficiency standards can lead to significant cost savings for building owners, further incentivizing the adoption of these roofing solutions. Additionally, the push for green building certifications is prompting many projects to consider liquid applied roofing as a viable option. As regulations continue to evolve, the Liquid Applied Roofing Market is likely to see sustained growth as stakeholders seek compliant and efficient roofing solutions.

Versatile Applications

The versatility of liquid applied roofing systems is another significant driver for the Liquid Applied Roofing Market. These systems can be applied to a variety of substrates, including metal, concrete, and existing roofing materials, which enhances their appeal across different sectors. This adaptability allows for seamless integration into both new constructions and renovation projects, thereby broadening the potential customer base. Market data suggests that the commercial sector, particularly in industrial and retail applications, is increasingly adopting liquid applied roofing due to its ease of installation and maintenance. Additionally, the ability to customize these systems for specific environmental conditions or aesthetic preferences further solidifies their position in the market. As the demand for flexible roofing solutions continues to grow, the Liquid Applied Roofing Market is poised to benefit from this trend.

Technological Advancements

Technological advancements in the formulation and application of liquid applied roofing materials are driving innovation within the Liquid Applied Roofing Market. Recent developments have led to the creation of high-performance coatings that offer enhanced durability, UV resistance, and waterproofing capabilities. These innovations not only improve the lifespan of roofing systems but also reduce maintenance costs for building owners. Market analysis indicates that the introduction of smart roofing technologies, which can monitor and respond to environmental conditions, is gaining traction. This integration of technology is expected to attract a new segment of customers who prioritize efficiency and longevity in their roofing solutions. As manufacturers continue to invest in research and development, the Liquid Applied Roofing Market is likely to experience a surge in demand for technologically advanced products.

Economic Growth and Infrastructure Development

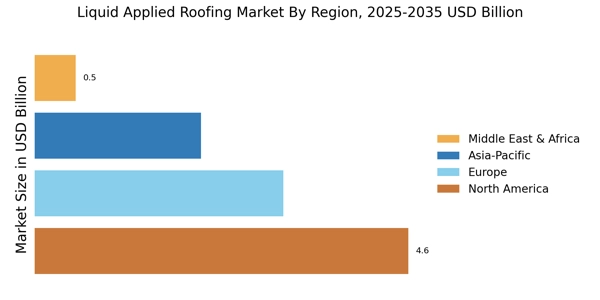

Economic growth and infrastructure development are fundamental drivers influencing the Liquid Applied Roofing Market. As economies expand, there is a corresponding increase in construction activities, particularly in commercial and residential sectors. This growth is often accompanied by investments in infrastructure, which necessitate durable and efficient roofing solutions. Market data indicates that regions experiencing rapid urbanization are particularly inclined to adopt liquid applied roofing systems due to their cost-effectiveness and longevity. Furthermore, government initiatives aimed at boosting infrastructure projects are likely to create additional demand for these roofing solutions. As the construction landscape evolves, the Liquid Applied Roofing Market stands to benefit from the ongoing economic development and the need for reliable roofing systems.