Growing Demand for Energy Security

The growing demand for energy security is a significant driver for the Liquefied Hydrogen Storage Market. As geopolitical tensions and supply chain vulnerabilities become more pronounced, nations are seeking alternative energy sources to enhance their energy independence. Hydrogen, particularly in its liquefied form, offers a flexible and secure energy solution that can be stored and transported efficiently. The ability to store large quantities of hydrogen allows countries to mitigate risks associated with energy supply disruptions. Additionally, the integration of hydrogen into existing energy systems can provide a buffer against fluctuations in energy prices. As energy security becomes a priority for many nations, the Liquefied Hydrogen Storage Market is poised to experience growth driven by this increasing demand.

Government Initiatives and Policies

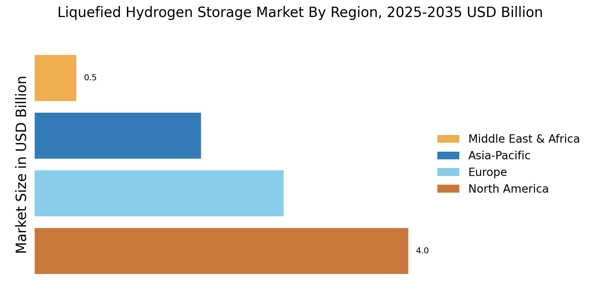

Government initiatives and policies aimed at promoting hydrogen technologies are significantly influencing the Liquefied Hydrogen Storage Market. Various countries have implemented strategic frameworks to support hydrogen production, storage, and utilization. For instance, funding programs and tax incentives are being introduced to encourage research and development in hydrogen technologies. The European Union has set ambitious targets for hydrogen production, aiming for 10 million tons of renewable hydrogen by 2030. Such policies not only stimulate investment in hydrogen infrastructure but also create a favorable environment for the growth of the liquefied hydrogen storage sector. As governments continue to prioritize clean energy solutions, the Liquefied Hydrogen Storage Market is likely to experience accelerated growth driven by these supportive measures.

Rising Investments in Renewable Energy

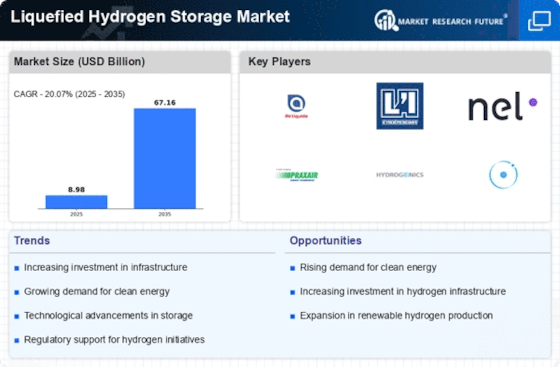

The surge in investments in renewable energy sources is a crucial driver for the Liquefied Hydrogen Storage Market. As the world transitions towards sustainable energy, hydrogen is increasingly recognized as a key component in energy storage and distribution. According to recent reports, investments in renewable energy technologies have reached unprecedented levels, with billions allocated to hydrogen projects. This influx of capital is fostering innovation in liquefied hydrogen storage solutions, enhancing efficiency and reducing costs. Moreover, the integration of hydrogen into renewable energy systems, such as wind and solar, necessitates effective storage solutions to manage supply and demand fluctuations. Consequently, the Liquefied Hydrogen Storage Market stands to gain from the growing emphasis on renewable energy investments, which are likely to drive advancements in storage technologies.

Increasing Adoption of Hydrogen as Fuel

The rising adoption of hydrogen as a clean fuel source is a pivotal driver for the Liquefied Hydrogen Storage Market. As nations strive to reduce carbon emissions, hydrogen is increasingly viewed as a viable alternative to fossil fuels. The International Energy Agency indicates that hydrogen could account for up to 18% of the total energy demand by 2050. This shift necessitates efficient storage solutions, thereby propelling the demand for liquefied hydrogen storage. Furthermore, the transportation sector, particularly heavy-duty vehicles, is progressively integrating hydrogen fuel cells, which further amplifies the need for robust storage systems. The Liquefied Hydrogen Storage Market is thus positioned to benefit from this transition towards hydrogen fuel, as it provides the necessary infrastructure to support widespread adoption.

Technological Innovations in Storage Systems

Technological innovations in storage systems are transforming the Liquefied Hydrogen Storage Market. Advances in cryogenic technology and materials science are leading to the development of more efficient and cost-effective storage solutions. Innovations such as advanced insulation materials and improved liquefaction processes are enhancing the viability of liquefied hydrogen storage. Furthermore, research into new storage methods, including metal hydrides and chemical hydrogen storage, is expanding the possibilities for hydrogen storage. These technological advancements not only improve the safety and efficiency of storage systems but also reduce operational costs. As the industry continues to evolve, the Liquefied Hydrogen Storage Market is likely to benefit from these innovations, which could lead to increased adoption and market growth.