Increased Investment in Biotechnology

The Life Science Software Market is witnessing increased investment in biotechnology, which is a key driver of market growth. As biopharmaceutical companies seek to innovate and develop new therapies, the demand for specialized software solutions that support research and development processes is on the rise. Reports indicate that investment in biotechnology is expected to reach unprecedented levels, with venture capital funding projected to exceed 30 billion dollars annually. This influx of capital is likely to spur the development of advanced software tools that cater to the unique needs of biotechnology firms, thereby enhancing productivity and accelerating the drug development lifecycle. Consequently, the life science software market is poised for substantial growth as it aligns with the evolving needs of the biotechnology sector.

Growing Focus on Personalized Medicine

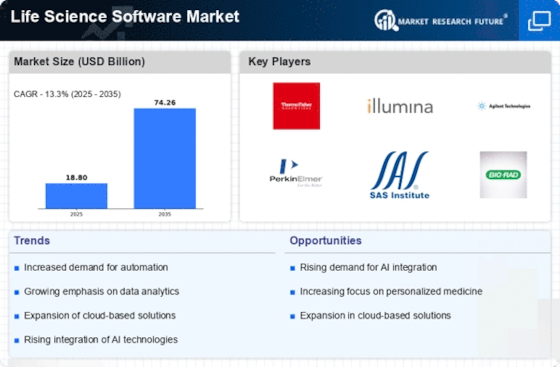

The Life Science Software Market is experiencing a growing focus on personalized medicine, which is reshaping the landscape of healthcare. As the demand for tailored treatment options increases, life science organizations are investing in software solutions that facilitate the analysis of genetic and clinical data. This trend is expected to propel market growth, with projections indicating a potential increase of 20% in the next few years. Personalized medicine requires sophisticated software tools that can integrate diverse data sources and provide insights into patient-specific treatment plans. Consequently, the life science software market is likely to expand as it supports the shift towards more individualized healthcare solutions.

Regulatory Compliance and Quality Assurance

The Life Science Software Market is heavily influenced by the need for regulatory compliance and quality assurance. As life science companies navigate complex regulatory landscapes, the demand for software solutions that ensure compliance with industry standards is paramount. The market for compliance-focused software is anticipated to grow at a rate of approximately 10% annually, driven by the increasing scrutiny from regulatory bodies. These software solutions assist organizations in maintaining accurate records, conducting audits, and ensuring adherence to Good Manufacturing Practices (GMP). Furthermore, the integration of quality assurance features within life science software enhances product safety and efficacy, thereby fostering trust among consumers and stakeholders.

Rising Demand for Data Management Solutions

The Life Science Software Market experiences a notable increase in demand for data management solutions. As research and development activities intensify, organizations require robust software to manage vast amounts of data generated during clinical trials and laboratory experiments. The market for data management solutions is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is driven by the need for efficient data handling, analysis, and storage, which are critical for regulatory compliance and successful product development. Furthermore, the integration of advanced analytics tools within data management software enhances decision-making processes, thereby improving overall operational efficiency in the life sciences sector.

Advancements in Cloud Computing Technologies

The Life Science Software Market is significantly influenced by advancements in cloud computing technologies. The adoption of cloud-based solutions allows life science organizations to access and share data seamlessly across various platforms, facilitating collaboration among researchers and stakeholders. This shift towards cloud computing is expected to drive market growth, with estimates suggesting a market expansion of around 15% in the next few years. Cloud solutions offer scalability, cost-effectiveness, and enhanced data security, which are essential for organizations aiming to streamline their operations. Additionally, the ability to leverage cloud infrastructure for big data analytics further empowers life science companies to derive actionable insights from their research data.