Rising Demand for Data-Driven Insights

The life science-analytics market is experiencing a notable surge in demand for data-driven insights. This trend is largely fueled by the increasing complexity of healthcare data and the need for actionable intelligence in decision-making processes. Organizations are investing heavily in analytics solutions to enhance operational efficiency and improve patient outcomes. According to recent estimates, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is indicative of a broader shift towards data-centric approaches in life sciences, where stakeholders seek to leverage analytics for competitive advantage. As a result, this market is becoming increasingly vital for organizations aiming to navigate the evolving landscape of healthcare..

Advancements in Technology Infrastructure

Technological advancements are playing a crucial role in shaping the life science-analytics market. The proliferation of cloud computing, big data technologies, and advanced analytics tools is enabling organizations to process vast amounts of data more efficiently. These innovations facilitate real-time data analysis, which is essential for timely decision-making in life sciences. Furthermore, the integration of sophisticated data visualization tools enhances the interpretability of complex datasets, making insights more accessible to stakeholders. As organizations continue to adopt these technologies, the life science-analytics market is expected to witness substantial growth, with investments in technology infrastructure projected to reach $10 billion by 2026. This trend underscores the importance of technology in driving analytics capabilities within the industry.

Regulatory Landscape and Compliance Needs

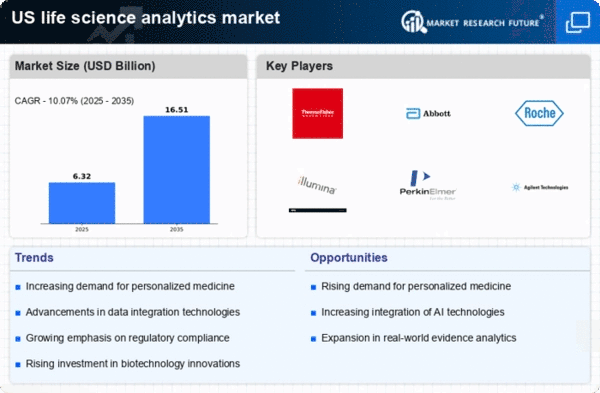

The evolving regulatory landscape is a significant driver for the life science-analytics market. As regulatory bodies impose stricter compliance requirements, organizations are compelled to adopt robust analytics solutions to ensure adherence to guidelines. This necessity is particularly pronounced in the pharmaceutical and biotechnology sectors, where data integrity and security are paramount. Companies are investing in analytics tools that not only streamline compliance processes but also enhance data governance. The life science-analytics market is thus positioned to grow as organizations seek to mitigate risks associated with non-compliance, with the market expected to reach $5 billion by 2025. This trend highlights the critical role of analytics in navigating regulatory challenges.

Increased Focus on Clinical Trials Efficiency

The life science-analytics market is significantly influenced by the growing emphasis on improving the efficiency of clinical trials. Organizations are increasingly utilizing analytics to streamline trial processes, reduce costs, and enhance patient recruitment strategies. By leveraging data analytics, companies can identify suitable patient populations more effectively and optimize trial designs. This shift is particularly relevant as the average cost of bringing a new drug to market has escalated to approximately $2.6 billion. Consequently, the life science-analytics market is becoming an essential component in the quest for more efficient clinical development pathways, with analytics solutions being integrated into trial management systems to facilitate better outcomes.

Growing Investment in Research and Development

Investment in research and development (R&D) is a key driver of the life science-analytics market. As organizations strive to innovate and develop new therapies, the demand for analytics solutions that can support R&D efforts is increasing. Companies are recognizing the value of data analytics in accelerating drug discovery and development processes. The life science-analytics market is projected to benefit from this trend, with R&D spending in the life sciences sector expected to exceed $200 billion by 2026. This investment not only fuels the growth of analytics solutions but also fosters collaboration between research institutions and analytics providers, further enhancing the capabilities of the life science-analytics market.