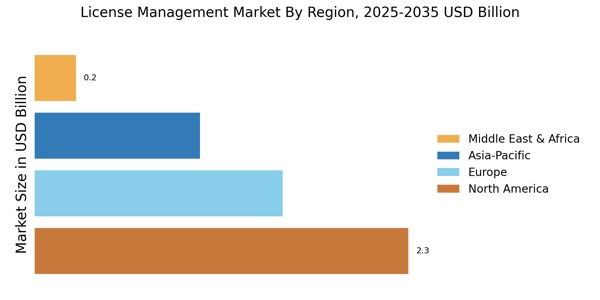

North America : Technology Adoption Leader

North America is the largest market for license management, holding approximately 45% of the global share. The region's growth is driven by rapid technological advancements, increasing software compliance requirements, and a strong focus on IT asset management. Regulatory frameworks, such as the Sarbanes-Oxley Act, further catalyze demand for effective license management solutions. The U.S. and Canada are the primary contributors to this market, with a significant push towards cloud-based solutions and automation.

The competitive landscape in North America is robust, featuring key players like Microsoft, IBM, and Oracle. These companies are continuously innovating to enhance their offerings, focusing on integration and user experience. The presence of numerous startups also fosters a dynamic environment, pushing established firms to adapt. As organizations increasingly prioritize compliance and cost management, the demand for sophisticated license management solutions is expected to grow, solidifying North America's leading position.

Europe : Regulatory Compliance Focus

Europe is the second-largest market for license management, accounting for approximately 30% of the global share. The region's growth is propelled by stringent regulatory requirements, such as the General Data Protection Regulation (GDPR), which necessitates effective software license management. Additionally, the increasing adoption of cloud services and digital transformation initiatives are driving demand for comprehensive license management solutions across various sectors.

Leading countries in Europe include Germany, the UK, and France, where major players like SAP and Snow Software are headquartered. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. The focus on compliance and risk management is pushing organizations to invest in advanced license management tools, ensuring they remain compliant with evolving regulations. This trend is expected to continue, further enhancing the market's growth potential.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing significant growth in the license management market, holding about 20% of the global share. The region's expansion is driven by increasing digitalization, a growing number of software users, and rising awareness of compliance issues. Countries like China and India are leading this growth, supported by government initiatives aimed at enhancing IT infrastructure and promoting software compliance. The demand for cloud-based solutions is also on the rise, further fueling market growth.

The competitive landscape in Asia-Pacific is diverse, with both local and international players competing for market share. Companies like ManageEngine and Certero are gaining traction, while global giants like Microsoft and IBM are also expanding their presence. As organizations in this region prioritize software asset management and compliance, the demand for effective license management solutions is expected to surge, making Asia-Pacific a key player in the global market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region is gradually emerging in the license management market, currently holding about 5% of the global share. The growth is driven by increasing digital transformation initiatives, rising software adoption, and a growing emphasis on compliance and governance. Countries like South Africa and the UAE are at the forefront, with governments promoting IT infrastructure development and software compliance regulations, which are essential for market growth.

The competitive landscape in MEA is still developing, with a mix of local and international players. Companies are beginning to recognize the importance of effective license management as they navigate complex regulatory environments. As organizations in this region increasingly focus on compliance and cost efficiency, the demand for sophisticated license management solutions is expected to rise, presenting significant growth opportunities for vendors and service providers.