Regulatory Support and Compliance

Regulatory frameworks are increasingly supporting the Smart Waste Management Market, as governments worldwide implement stricter waste management policies. These regulations often mandate the adoption of smart technologies to improve waste segregation, recycling rates, and overall waste management efficiency. For example, certain regions have set ambitious targets for waste reduction and recycling, which necessitate the use of smart waste management solutions. This regulatory push is likely to drive market growth, as companies seek to comply with these standards while enhancing their operational capabilities.

Integration of Advanced Technologies

The Smart Waste Management Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence and machine learning. These technologies facilitate real-time monitoring and data analysis, which enhances operational efficiency. For instance, predictive analytics can optimize waste collection routes, reducing fuel consumption and operational costs. According to recent estimates, the adoption of AI in waste management could lead to a reduction in operational costs by up to 30%. This technological integration not only streamlines processes but also improves service delivery, making it a crucial driver in the Smart Waste Management Market.

Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are pivotal drivers in the Smart Waste Management Market. Organizations are increasingly recognizing the financial benefits of implementing smart waste management solutions, which can lead to substantial savings in operational costs. For instance, smart bins equipped with sensors can monitor waste levels and optimize collection schedules, reducing unnecessary trips and associated costs. Furthermore, the ability to recycle and recover materials effectively can enhance resource utilization, making waste management not only environmentally friendly but also economically viable. This focus on cost efficiency is likely to propel the market forward.

Rising Urbanization and Population Growth

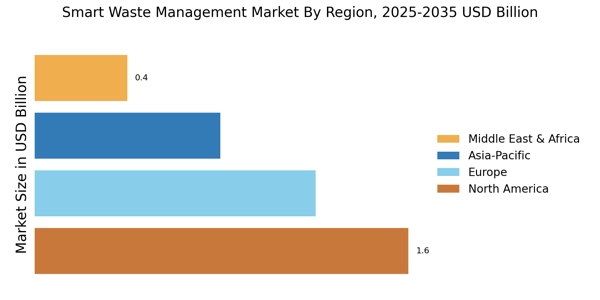

The Smart Waste Management Market is significantly influenced by rising urbanization and population growth. As urban areas expand, the volume of waste generated increases, necessitating more efficient waste management solutions. It is projected that by 2025, urban populations will account for over 55% of the total global population, leading to an estimated increase in waste generation by 70%. This surge in waste production creates a pressing need for smart waste management systems that can handle the complexities of urban waste efficiently, thereby driving market demand.

Increased Awareness of Environmental Issues

There is a growing awareness of environmental issues among consumers and businesses, which is positively impacting the Smart Waste Management Market. As sustainability becomes a priority, organizations are increasingly adopting smart waste management solutions to minimize their environmental footprint. This trend is reflected in the rising investments in waste-to-energy technologies and recycling initiatives. Companies that implement smart waste management practices not only enhance their corporate social responsibility but also improve their brand image, making this awareness a significant driver of market growth.