Evolving Regulatory Frameworks

The Letter of Credit Confirmation Market is influenced by the evolving regulatory frameworks that govern international trade and finance. Regulatory bodies are increasingly focusing on enhancing compliance measures to mitigate risks associated with trade financing. In 2025, it is anticipated that stricter regulations will be implemented, compelling banks to adopt more robust compliance protocols. This shift may lead to an increased reliance on confirmed letters of credit, as they provide a layer of security for both exporters and importers. Consequently, the Letter of Credit Confirmation Market is likely to see a rise in demand as businesses seek to navigate the complexities of regulatory compliance.

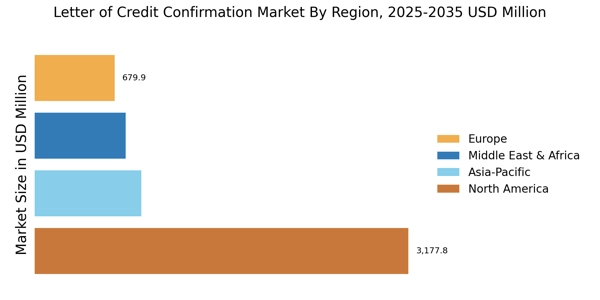

Rising International Trade Activities

The Letter of Credit Confirmation Market is experiencing a surge in demand due to the increasing volume of international trade activities. As businesses expand their operations across borders, the need for secure payment mechanisms becomes paramount. In 2025, the value of global merchandise trade is projected to reach approximately 25 trillion USD, indicating a robust growth trajectory. This growth in trade necessitates the use of letters of credit, which provide assurance to exporters and importers alike. Consequently, the Letter of Credit Confirmation Market is likely to benefit from this trend, as financial institutions and banks enhance their services to accommodate the rising demand for confirmed letters of credit.

Technological Advancements in Banking

Technological innovations are reshaping the Letter of Credit Confirmation Market, as banks and financial institutions increasingly adopt digital solutions to streamline processes. The integration of blockchain technology, for instance, is enhancing transparency and security in transactions. In 2025, it is estimated that over 60% of banks will implement advanced digital platforms for trade finance, including letter of credit confirmations. This shift not only reduces processing times but also minimizes the risk of fraud, thereby fostering greater trust among trading partners. As a result, the Letter of Credit Confirmation Market is poised for growth, driven by the need for efficient and secure transaction methods.

Increased Focus on Supply Chain Resilience

The Letter of Credit Confirmation Market is also benefiting from an increased focus on supply chain resilience. Companies are recognizing the importance of maintaining robust supply chains to withstand disruptions. As a result, there is a growing inclination towards using letters of credit to ensure that suppliers are paid promptly, thereby fostering stronger relationships. In 2025, it is expected that more than 50% of companies will prioritize financial instruments that enhance supply chain stability. This trend is likely to drive demand for confirmed letters of credit, as they provide a reliable mechanism for securing payments and ensuring continuity in supply chain operations.

Growing Demand for Risk Mitigation Solutions

In an increasingly volatile economic environment, the demand for risk mitigation solutions is driving growth in the Letter of Credit Confirmation Market. Businesses are seeking ways to protect themselves against payment defaults and geopolitical risks. The use of confirmed letters of credit serves as a safeguard, ensuring that exporters receive payment upon compliance with the terms of the credit. In 2025, it is projected that the market for trade finance solutions, including letters of credit, will grow by approximately 10% annually. This trend indicates a heightened awareness among businesses regarding the importance of securing transactions, thereby bolstering the Letter of Credit Confirmation Market.