Rise of Smart Contracts

The rise of smart contracts is transforming the Blockchain in Fintech Market by automating and streamlining various financial processes. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can facilitate transactions without the need for intermediaries. This automation not only reduces the potential for human error but also accelerates transaction times. In sectors such as insurance and real estate, smart contracts can simplify complex processes, leading to increased efficiency. As the market for smart contracts expands, it is projected that their adoption could lead to a 30% reduction in operational costs for financial institutions, thereby enhancing the overall appeal of blockchain technology in the fintech sector.

Regulatory Clarity and Support

Regulatory clarity is becoming a significant driver in the Blockchain in Fintech Market. As governments and regulatory bodies establish frameworks for blockchain technology, financial institutions are more inclined to adopt these solutions. Clear regulations can mitigate risks associated with compliance and legal uncertainties, which have historically hindered blockchain adoption. Recent initiatives by various governments to create supportive regulatory environments indicate a shift towards embracing blockchain technology. For instance, some jurisdictions are implementing sandbox models that allow fintech companies to test blockchain applications in a controlled environment. This regulatory support is likely to encourage more financial institutions to explore blockchain solutions, thereby accelerating the integration of this technology into mainstream financial services.

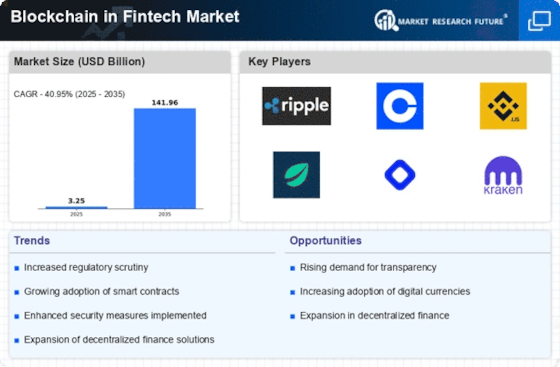

Growing Demand for Transparency

The Blockchain in Fintech Market is witnessing a growing demand for transparency in financial transactions. As consumers and businesses alike seek to understand the flow of funds, blockchain technology offers an immutable ledger that enhances visibility. This transparency is particularly appealing in sectors such as banking and insurance, where trust is paramount. According to recent data, approximately 70% of financial institutions are exploring blockchain solutions to improve transparency. This trend is likely to drive the adoption of blockchain technologies, as stakeholders recognize the potential for reducing fraud and increasing accountability. Furthermore, the ability to track transactions in real-time may lead to more informed decision-making, thereby fostering a more robust financial ecosystem.

Increased Investment in Blockchain Startups

Investment in blockchain startups is surging, which is a crucial driver for the Blockchain in Fintech Market. Venture capitalists and institutional investors are increasingly recognizing the potential of blockchain technology to disrupt traditional financial services. In recent years, funding for blockchain-related ventures has reached unprecedented levels, with billions of dollars being allocated to innovative projects. This influx of capital not only supports the development of new technologies but also fosters a competitive environment that encourages innovation. As more startups emerge, the diversity of solutions available in the market expands, potentially leading to enhanced services and products for consumers and businesses alike. This trend is likely to sustain momentum in the fintech sector, as investment continues to flow into blockchain initiatives.

Cost Efficiency and Reduced Transaction Fees

Cost efficiency remains a pivotal driver in the Blockchain in Fintech Market. Traditional financial systems often incur high transaction fees and lengthy processing times, particularly in cross-border payments. Blockchain technology, with its decentralized nature, has the potential to significantly reduce these costs. Reports indicate that blockchain can lower transaction fees by up to 40%, making it an attractive option for businesses and consumers. This cost-effectiveness is particularly beneficial for remittances, where high fees can erode the value of funds sent across borders. As more financial institutions recognize the economic advantages of blockchain, the industry is likely to see an uptick in adoption, further solidifying its role in the fintech landscape.