Growing Investor Interest in Green Finance

The carbon credit-trading-platform market is witnessing a notable increase in investor interest in green finance. As environmental, social, and governance (ESG) criteria become more prominent in investment decisions, investors are increasingly looking for opportunities in carbon markets. In 2025, it is estimated that investments in green bonds and carbon credits could reach $1 trillion, reflecting a growing recognition of the financial viability of sustainable investments. This influx of capital is likely to drive innovation and competition within the carbon credit-trading-platform market, as platforms strive to offer more attractive products and services to meet investor demands. Furthermore, the alignment of financial returns with environmental impact is expected to create a more dynamic trading environment, fostering greater participation from institutional investors.

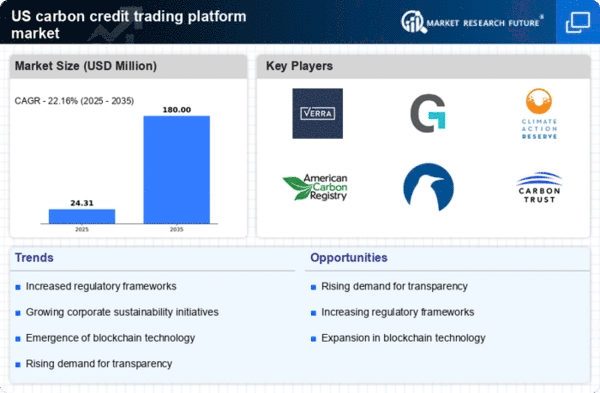

Increased Corporate Sustainability Initiatives

The carbon credit-trading-platform market is experiencing a surge in demand due to heightened corporate sustainability initiatives. Companies across various sectors are increasingly committing to net-zero emissions targets, which necessitates the acquisition of carbon credits to offset their carbon footprints. In 2025, it is estimated that over 60% of Fortune 500 companies have set ambitious sustainability goals, driving the need for robust trading platforms. This trend indicates a shift in corporate responsibility, where businesses are not only focusing on profitability but also on environmental stewardship. The carbon credit-trading-platform market is thus positioned to benefit from this growing emphasis on sustainability, as firms seek efficient ways to manage their carbon liabilities and enhance their reputations in the eyes of consumers and investors alike.

Expansion of State-Level Cap-and-Trade Programs

The carbon credit-trading-platform market is significantly influenced by the expansion of state-level cap-and-trade programs in the US. As of November 2025, several states have implemented or are in the process of developing their own cap-and-trade systems, which regulate greenhouse gas emissions and create a market for carbon credits. For instance, California's cap-and-trade program has been a model for other states, leading to a projected increase in carbon credit transactions by approximately 25% over the next year. This regulatory landscape encourages businesses to engage with carbon credit-trading platforms, as they seek to comply with state regulations while optimizing their emissions strategies. The proliferation of these programs is likely to enhance market liquidity and attract new participants, further solidifying the role of trading platforms in the carbon credit ecosystem.

Rising Public Awareness and Demand for Carbon Offsetting

The carbon credit-trading-platform market is benefiting from rising public awareness and demand for carbon offsetting solutions. As climate change becomes an increasingly pressing issue, consumers are more inclined to support businesses that actively engage in carbon offsetting practices. Surveys indicate that approximately 70% of consumers in the US are willing to pay a premium for products and services that contribute to carbon neutrality. This shift in consumer behavior is prompting companies to invest in carbon credits as a means of enhancing their sustainability profiles. Consequently, the carbon credit-trading-platform market is likely to see an influx of new participants seeking to purchase credits to meet consumer expectations. This growing demand not only supports market growth but also encourages innovation in the development of new carbon offset projects.

Technological Advancements in Blockchain and Data Analytics

The carbon credit-trading-platform market is being transformed by technological advancements, particularly in blockchain and data analytics. These technologies enhance transparency, traceability, and efficiency in carbon credit transactions. By November 2025, several platforms have begun integrating blockchain solutions to ensure the integrity of carbon credits and streamline the trading process. Additionally, advanced data analytics tools are being utilized to provide real-time insights into market trends and pricing, enabling participants to make informed decisions. This technological evolution not only improves the user experience but also attracts a broader range of participants, including smaller businesses and individual investors. As these technologies continue to evolve, they are likely to play a crucial role in shaping the future of the carbon credit-trading-platform market.