Expansion of the Beverage Sector

The beverage sector's expansion is a crucial driver for the Lemon Compound Market. With the growing popularity of flavored beverages, including soft drinks, teas, and health drinks, the demand for lemon compounds is expected to rise. Market analysis suggests that the beverage industry is experiencing a robust growth trajectory, with flavored drinks accounting for a substantial share of the market. This trend is likely to propel the Lemon Compound Market forward, as manufacturers increasingly incorporate lemon flavors to enhance product appeal. Additionally, the rise of functional beverages, which often utilize lemon compounds for their refreshing taste and potential health benefits, further underscores the importance of this driver. As consumers gravitate towards innovative beverage options, the Lemon Compound Market is poised to capitalize on these evolving preferences.

Sustainability Initiatives in Production

Sustainability initiatives in production processes are emerging as a vital driver for the Lemon Compound Market. As environmental concerns gain prominence, manufacturers are increasingly adopting sustainable practices to meet consumer expectations. This includes sourcing lemons from sustainable farms and utilizing eco-friendly extraction methods. Market data suggests that consumers are willing to pay a premium for products that align with their values, indicating a potential growth area for the Lemon Compound Market. By prioritizing sustainability, companies can enhance their brand image and appeal to environmentally conscious consumers. Furthermore, as regulations surrounding sustainability tighten, the Lemon Compound Market may experience a shift towards more responsible sourcing and production practices, ultimately benefiting both the environment and the market's long-term viability.

Growing Interest in Culinary Applications

The culinary sector's growing interest in unique flavor profiles is a significant driver for the Lemon Compound Market. Chefs and home cooks alike are increasingly experimenting with lemon compounds to elevate their culinary creations. This trend is supported by market data showing a rise in gourmet cooking and the popularity of cooking shows, which often highlight the use of citrus flavors. As consumers seek to replicate restaurant-quality dishes at home, the demand for lemon compounds in sauces, marinades, and dressings is likely to increase. The Lemon Compound Market stands to benefit from this culinary renaissance, as manufacturers develop innovative products tailored to the needs of both professional chefs and home cooks. This evolving landscape presents opportunities for growth and diversification within the market.

Rising Demand for Natural Flavoring Agents

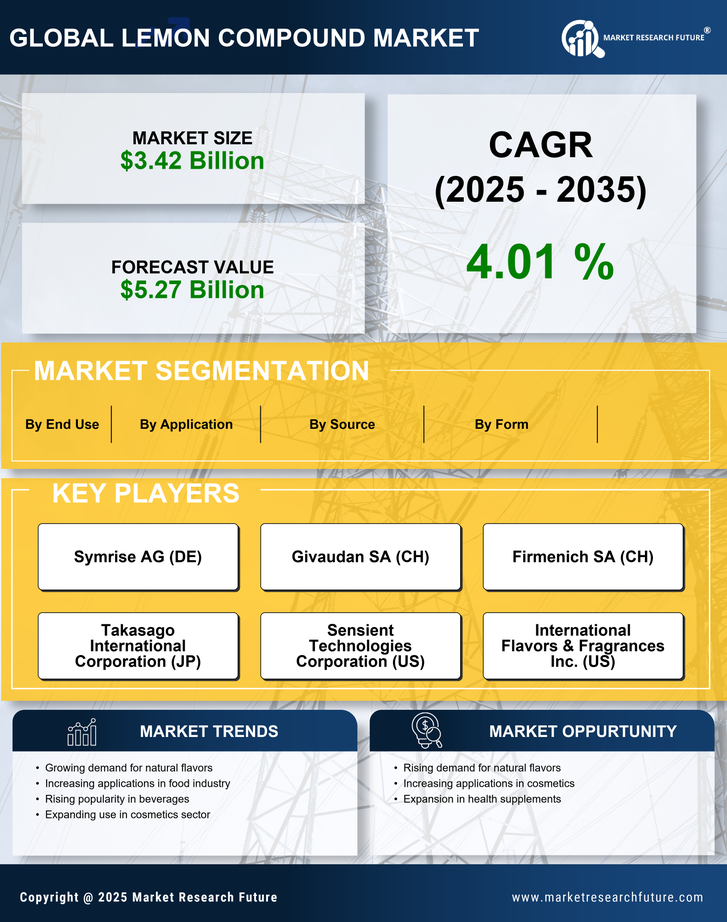

The increasing consumer preference for natural flavoring agents is a pivotal driver in the Lemon Compound Market. As health-conscious consumers seek alternatives to synthetic additives, the demand for lemon compounds, which are derived from natural sources, is likely to surge. This trend is reflected in market data, indicating that the natural flavoring segment is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. The Lemon Compound Market stands to benefit significantly from this shift, as manufacturers adapt their product lines to meet the rising demand for clean-label products. Furthermore, the incorporation of lemon compounds in various food and beverage applications enhances flavor profiles while aligning with consumer expectations for transparency and health benefits.

Increased Application in Personal Care Products

The Lemon Compound Market is witnessing a notable increase in the application of lemon compounds within personal care products. As consumers become more aware of the benefits of natural ingredients in skincare and cosmetics, the demand for lemon-based formulations is likely to grow. Market data indicates that the personal care sector is projected to expand at a rate of approximately 4% annually, with lemon compounds being favored for their refreshing scent and potential skin benefits. This trend is indicative of a broader movement towards clean and natural beauty products, which aligns with consumer preferences for transparency and efficacy. Consequently, the Lemon Compound Market is expected to see a rise in partnerships with personal care brands seeking to incorporate lemon compounds into their offerings, thereby enhancing product differentiation and appeal.