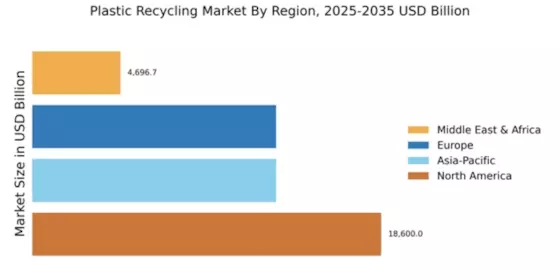

North America : Leading Market Innovators

North America is poised to maintain its leadership in the plastic recycling market, holding a significant share of 18600.0. The region's growth is driven by stringent regulations promoting recycling, increasing consumer awareness, and technological advancements in recycling processes. Demand for recycled plastics is surging as companies aim to meet sustainability goals, further supported by government initiatives encouraging circular economy practices. The competitive landscape is robust, with key players like Waste Management, Republic Services, and Coca-Cola leading the charge. The U.S. is the primary market, benefiting from a well-established infrastructure for waste management and recycling. Companies are investing heavily in innovative technologies to enhance recycling efficiency, positioning themselves as leaders in sustainability and environmental responsibility.

Europe : Sustainability Focused Region

Europe's plastic recycling market is projected at 13000.0, driven by ambitious EU regulations aimed at reducing plastic waste and promoting recycling. The European Green Deal and Circular Economy Action Plan are pivotal in shaping market dynamics, encouraging member states to adopt stringent recycling targets. This regulatory framework is fostering innovation and investment in recycling technologies, making Europe a leader in sustainable practices. Germany, France, and the UK are at the forefront, with companies like Veolia and SUEZ leading the market. The competitive landscape is characterized by a mix of large multinationals and innovative startups, all striving to meet the growing demand for recycled materials. The region's commitment to sustainability is evident in its investments in advanced recycling technologies and public awareness campaigns.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 13000.0, is witnessing rapid growth in plastic recycling driven by increasing urbanization and rising environmental concerns. Countries like China and India are implementing stricter regulations on plastic waste management, which is catalyzing demand for recycling solutions. The region's growth is further supported by investments in recycling infrastructure and technology, aiming to reduce plastic pollution and enhance sustainability efforts. China remains a dominant player, with significant investments in recycling facilities and technologies. Other countries, including Japan and South Korea, are also enhancing their recycling capabilities. The competitive landscape is evolving, with both local and international players striving to capture market share in this burgeoning sector, focusing on innovative recycling methods and sustainable practices.

Middle East and Africa : Developing Recycling Initiatives

The Middle East and Africa region, with a market size of 4696.7, is gradually developing its plastic recycling initiatives. The growth is driven by increasing awareness of environmental issues and the need for sustainable waste management solutions. Governments are beginning to implement regulations aimed at reducing plastic waste, which is fostering a nascent recycling market. However, challenges such as limited infrastructure and public awareness still hinder rapid growth. Countries like South Africa and the UAE are leading the charge, with initiatives to improve recycling rates and reduce plastic pollution. The competitive landscape is still emerging, with local companies and international players exploring opportunities in the region. Investments in recycling technologies and public-private partnerships are essential for enhancing the recycling ecosystem and achieving sustainability goals.