Regulatory Compliance

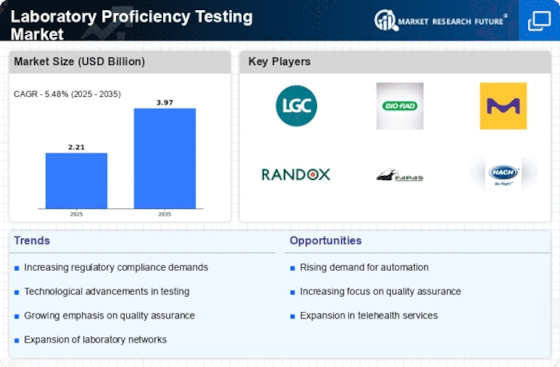

Regulatory compliance remains a critical driver within the Laboratory Proficiency Testing Market. Laboratories are mandated to adhere to stringent regulations set forth by various health and safety organizations. These regulations ensure that laboratories maintain high standards of quality and accuracy in their testing processes. As regulatory bodies continue to evolve their guidelines, laboratories are compelled to engage in proficiency testing to demonstrate compliance. This necessity creates a consistent demand for proficiency testing services, as laboratories seek to validate their testing capabilities. Recent statistics indicate that the compliance market is expanding, with a growing number of laboratories recognizing the importance of maintaining accreditation. Consequently, the Laboratory Proficiency Testing Market is likely to benefit from this ongoing emphasis on regulatory adherence, as laboratories prioritize proficiency testing to meet compliance requirements.

Technological Advancements

The Laboratory Proficiency Testing Market is experiencing a notable transformation due to rapid technological advancements. Innovations in automation, data analytics, and artificial intelligence are enhancing the efficiency and accuracy of proficiency testing. For instance, the integration of advanced software solutions allows laboratories to streamline their testing processes, thereby reducing human error and improving overall quality. According to recent data, the market for laboratory automation is projected to grow significantly, indicating a shift towards more sophisticated testing methodologies. This trend not only enhances the reliability of test results but also fosters a competitive environment among laboratories striving for excellence. As laboratories increasingly adopt these technologies, the demand for proficiency testing services is likely to rise, further propelling the Laboratory Proficiency Testing Market.

Collaborative Testing Approaches

Collaborative testing approaches are emerging as a pivotal trend within the Laboratory Proficiency Testing Market. By fostering partnerships among laboratories, organizations can share resources, knowledge, and best practices, ultimately enhancing the quality of proficiency testing. This collaborative model not only improves the accuracy of test results but also encourages laboratories to adopt standardized testing protocols. As more laboratories recognize the benefits of collaboration, the demand for proficiency testing services is expected to increase. Data suggests that collaborative initiatives can lead to improved performance metrics, as laboratories work together to identify areas for improvement. This trend indicates a shift towards a more interconnected laboratory ecosystem, where proficiency testing becomes a shared responsibility. As such, the Laboratory Proficiency Testing Market is likely to see growth driven by these collaborative efforts.

Increased Focus on Quality Assurance

An increased focus on quality assurance is significantly influencing the Laboratory Proficiency Testing Market. Laboratories are under constant pressure to deliver accurate and reliable test results, which has led to a heightened emphasis on quality management systems. This focus on quality assurance is driving laboratories to participate in proficiency testing programs to validate their testing processes. Recent data indicates that laboratories that engage in regular proficiency testing demonstrate improved performance and reduced error rates. As the demand for high-quality testing services continues to rise, laboratories are likely to invest more in proficiency testing to ensure compliance with industry standards. This trend not only enhances the credibility of laboratories but also contributes to the overall growth of the Laboratory Proficiency Testing Market.

Rising Demand for Diagnostic Testing

The rising demand for diagnostic testing is a key driver of the Laboratory Proficiency Testing Market. As healthcare systems worldwide strive to improve patient outcomes, the need for accurate and timely diagnostic tests has become paramount. This surge in demand is prompting laboratories to enhance their testing capabilities, leading to an increased reliance on proficiency testing to ensure the accuracy of results. Market data indicates that the diagnostic testing sector is expanding rapidly, with a growing number of tests being developed and implemented. Consequently, laboratories are recognizing the importance of proficiency testing as a means to validate their testing processes and maintain high standards. This trend is likely to propel the Laboratory Proficiency Testing Market forward, as laboratories seek to meet the rising expectations of healthcare providers and patients alike.