Changing Consumer Preferences

Changing consumer preferences towards healthier lifestyles and alternative transportation options appear to be influencing the Bike Sharing Market. As more individuals prioritize fitness and well-being, cycling has emerged as a popular choice for both commuting and leisure activities. Market data suggests that bike-sharing programs are witnessing increased participation from diverse demographics, including young professionals and families. This shift in consumer behavior indicates a growing acceptance of cycling as a practical and enjoyable mode of transport. Consequently, the Bike Sharing Market is likely to experience sustained growth as it aligns with the evolving preferences of modern consumers.

Urbanization and Population Growth

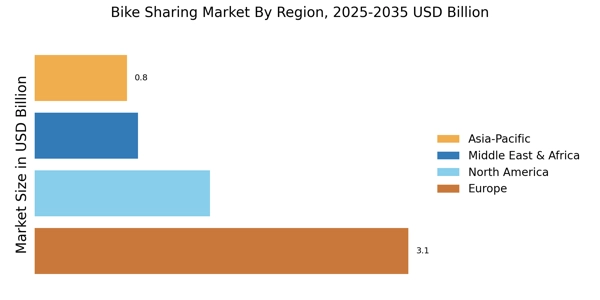

The rapid urbanization and population growth in various regions appear to be a driving force for the Bike Sharing Market. As cities expand and populations increase, the demand for efficient and sustainable transportation options intensifies. In many metropolitan areas, the number of bike-sharing programs has surged, with cities like Paris and New York reporting significant increases in bike usage. This trend suggests that urban planners are increasingly integrating bike-sharing systems into public transportation networks, thereby enhancing accessibility and reducing traffic congestion. The Bike Sharing Market is likely to benefit from this urban shift, as more individuals seek convenient alternatives to traditional commuting methods.

Technological Advancements in Mobility

Technological advancements in mobility solutions appear to be reshaping the Bike Sharing Market. The integration of mobile applications, GPS tracking, and smart locks has enhanced user experience and operational efficiency. Data from various bike-sharing programs indicate that the use of technology has led to increased user engagement and satisfaction. For instance, real-time tracking allows users to locate available bikes easily, while mobile payments streamline the rental process. This technological evolution not only attracts new users but also encourages existing users to utilize bike-sharing services more frequently. The Bike Sharing Market is likely to continue evolving as technology plays a crucial role in its growth.

Government Support and Policy Initiatives

Government support and policy initiatives are likely to play a significant role in the expansion of the Bike Sharing Market. Many governments are implementing policies that promote cycling as a viable mode of transportation, including subsidies for bike-sharing programs and investments in cycling infrastructure. For example, cities are increasingly allocating funds for bike lanes and parking facilities, which can enhance the overall user experience. This supportive regulatory environment may lead to a proliferation of bike-sharing services, as municipalities recognize the benefits of reducing traffic congestion and improving public health. The Bike Sharing Market stands to gain from such proactive governmental measures.

Environmental Awareness and Sustainability

Growing environmental awareness among consumers seems to be a pivotal driver for the Bike Sharing Market. As individuals become more conscious of their carbon footprints, there is a noticeable shift towards eco-friendly transportation solutions. Reports indicate that bike-sharing programs can reduce greenhouse gas emissions significantly, making them an attractive option for environmentally conscious users. Furthermore, cities are increasingly promoting bike-sharing initiatives as part of their sustainability goals, which may lead to increased funding and support for these programs. The Bike Sharing Market is thus positioned to thrive as sustainability becomes a core value for both consumers and urban policymakers.