Kefir Size

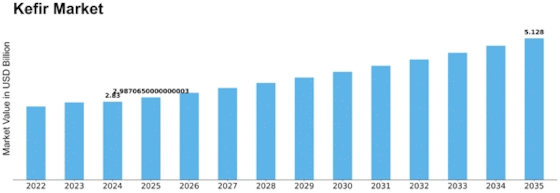

Kefir Market Growth Projections and Opportunities

Rapid growth of Kefir Market The market for Kefir is rapidly growing because of the interrelated factors that indicate changes in consumer tastes and their demand about health issues. One of the major reasons behind this popularity is that increasingly more people are informed about how useful kefir can be for their health. Kefir is a cultured dairy drink and it includes probiotic bacteria, vitamins that are beneficial to the digestion system including general status of health. The market for kefir has been growing steadily because more individuals are now looking towards functional foods that contribute to gut health. Cultural and lifestyle factors are significant in defining the Kefir Market. Kefir originated in Eastern European and Middle East regions where it was consumed by people for hundreds of years. Kefir is authentic and attractive partly because of its cultural associations, as well historical use. Further, the spread of health-oriented lifestyles and growing interest in a variety of national culinary traditions contribute to consumer choices and promote kefir consumption across diverse diets around the world. Kefir market is also influenced by the global trend toward plant-based alternatives. Classic kefir is manufactured from dairy milk, but recent years have seen the appearance of non-dairy and vegan alternatives. Most people who are lactose intolerant or under a vegan diet prefer plant-based kefir, mostly made of coconut milk almond milk and soy. The wide range of kefir varieties is compatible with the trend toward plant-based and alternative proteins. The evolution of Kefir Market is due to technological advancements and innovation in production methods. Manufacturers are looking for new formulations, flavours, and packaging strategies to make kefir products more appealing. The creation of easy to use single-serving bottles, flavoured varieties such as kefir and the addition of more functional ingredients diversify the market even further. Innovation also takes it to the production of water kefir, which is non-dairy alternative fermented with sugar and fruit offering a more diverse range for consumers. A key factor that influences the Kefir Market is regulatory environment. Manufacturers should comply with food safety standards, labelling requirements, and nutritional claims to gain consumer trust. Additionally, marketing strategies and product labelling are affected by terms like “probiotic” or “fermented,” which carries regulatory scrutiny. Obeying these regulations is essential for kefir products’ quality and integrity in the market.

Leave a Comment