Rise in Enrollment Rates

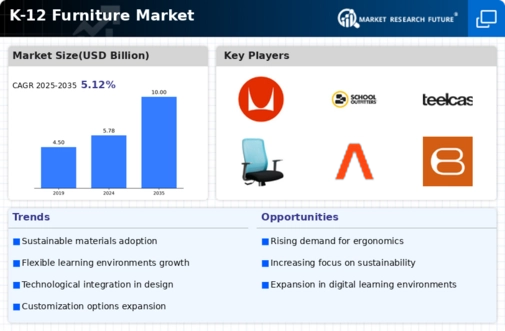

The K-12 Furniture Market is poised for growth due to rising enrollment rates in educational institutions. As more students enroll in schools, the demand for furniture that accommodates larger class sizes is increasing. Data suggests that many regions are witnessing a surge in student populations, necessitating the expansion and renovation of existing facilities. This trend compels schools to invest in new furniture that is not only functional but also adaptable to various learning environments. Consequently, manufacturers are responding by offering versatile furniture solutions that can be easily reconfigured to suit different classroom layouts. This increase in enrollment is expected to significantly impact the K-12 Furniture Market, driving sales and innovation.

Increased Focus on Student Well-Being

The K-12 Furniture Market is experiencing a notable shift towards designs that prioritize student well-being. Educational institutions are increasingly recognizing the importance of creating environments that foster mental and physical health. This trend is reflected in the growing demand for ergonomic furniture that supports proper posture and reduces discomfort during long hours of study. Research indicates that well-designed learning spaces can enhance student engagement and academic performance. As a result, manufacturers are innovating to provide furniture solutions that not only meet functional needs but also contribute to a positive learning atmosphere. This focus on well-being is likely to drive growth in the K-12 Furniture Market, as schools invest in furniture that aligns with their educational goals.

Sustainability Initiatives in Education

The K-12 Furniture Market is experiencing a growing emphasis on sustainability initiatives within educational institutions. Schools are increasingly seeking furniture made from eco-friendly materials and sustainable manufacturing processes. This trend is driven by a broader societal shift towards environmental responsibility and the desire to instill these values in students. Data indicates that a significant portion of schools is prioritizing the procurement of sustainable furniture, which not only reduces their carbon footprint but also promotes awareness among students. As a result, manufacturers in the K-12 Furniture Market are adapting their product lines to include sustainable options, which is likely to enhance their market appeal and align with the values of modern educational institutions.

Emphasis on Collaborative Learning Spaces

The K-12 Furniture Market is witnessing a transformation driven by the emphasis on collaborative learning spaces. Educational institutions are increasingly adopting teaching methodologies that promote teamwork and interaction among students. This shift necessitates the design of furniture that facilitates group work and collaborative projects. Manufacturers are responding by creating modular and flexible furniture solutions that can be easily rearranged to support various group activities. Research indicates that collaborative learning environments can enhance critical thinking and problem-solving skills among students. As schools continue to prioritize collaborative learning, the K-12 Furniture Market is likely to see sustained growth, with a focus on innovative designs that cater to these educational trends.

Technological Advancements in Furniture Design

The K-12 Furniture Market is being influenced by technological advancements that enhance the functionality and appeal of educational furniture. Innovations such as integrated charging stations, smart desks, and interactive surfaces are becoming increasingly prevalent in classrooms. These advancements not only support the integration of technology into learning but also cater to the needs of tech-savvy students. As schools seek to create modern learning environments, the demand for furniture that incorporates these technologies is expected to rise. This trend suggests that manufacturers will need to invest in research and development to stay competitive in the K-12 Furniture Market, ensuring that their products meet the evolving needs of educational institutions.

Leave a Comment