Increasing Prevalence of Joint Disorders

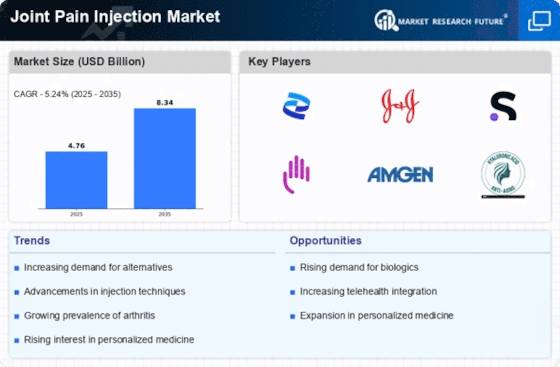

The rising incidence of joint disorders, such as osteoarthritis and rheumatoid arthritis, is a primary driver of the Joint Pain Injection Market. According to recent estimates, millions of individuals are affected by these conditions, leading to a growing demand for effective treatment options. As the population ages, the prevalence of joint-related ailments is expected to escalate, further propelling the market. The Joint Pain Injection Market is likely to benefit from this trend, as patients seek alternatives to traditional pain management methods. This increasing prevalence not only highlights the need for innovative therapies but also underscores the importance of timely interventions to improve patients' quality of life. Consequently, healthcare providers are increasingly turning to injection therapies as a viable solution, thereby expanding the market's potential.

Shift Towards Minimally Invasive Procedures

The ongoing shift towards minimally invasive procedures is reshaping the Joint Pain Injection Market. Patients increasingly prefer treatments that offer quicker recovery times and reduced risks compared to traditional surgical options. Injection therapies, which are often performed on an outpatient basis, align well with this preference. As a result, there is a growing trend among healthcare providers to adopt injection therapies as a primary method for managing joint pain. This shift not only enhances patient satisfaction but also reduces the overall burden on healthcare systems. The Joint Pain Injection Market is likely to experience growth as more patients opt for these less invasive alternatives, leading to an increase in the adoption of injection therapies across various healthcare settings.

Growing Investment in Healthcare Infrastructure

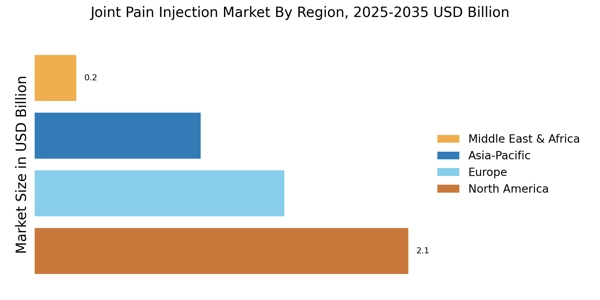

The expansion of healthcare infrastructure is a significant driver of the Joint Pain Injection Market. Increased investment in healthcare facilities, particularly in emerging markets, is enhancing access to advanced treatment options, including joint pain injections. As hospitals and clinics upgrade their capabilities, they are more likely to offer a wider range of injection therapies to meet patient needs. This trend is particularly evident in regions where healthcare access has historically been limited. The Joint Pain Injection Market is poised to benefit from this growth, as improved infrastructure facilitates the delivery of innovative treatments. Furthermore, as healthcare systems evolve, there is a greater emphasis on integrating advanced pain management solutions, which will likely bolster the market.

Technological Advancements in Injection Therapies

Technological innovations in injection therapies are significantly influencing the Joint Pain Injection Market. Recent advancements, such as the development of ultrasound-guided injections and improved needle designs, enhance the precision and efficacy of treatments. These innovations not only minimize patient discomfort but also increase the success rates of injections. Furthermore, the introduction of biologics and regenerative medicine techniques, such as platelet-rich plasma (PRP) injections, is transforming the landscape of joint pain management. As these technologies continue to evolve, they are expected to attract more patients seeking effective and less invasive treatment options. The Joint Pain Injection Market stands to gain from these advancements, as they align with the growing demand for safer and more effective therapies.

Rising Awareness and Acceptance of Injection Treatments

There is a notable increase in awareness and acceptance of injection treatments among patients and healthcare professionals, which is driving the Joint Pain Injection Market. Educational initiatives and marketing campaigns have played a crucial role in informing patients about the benefits of injection therapies, such as corticosteroids and hyaluronic acid injections. As more individuals become aware of these options, the demand for such treatments is likely to rise. Additionally, healthcare providers are increasingly recommending injection therapies as first-line treatments for joint pain, further solidifying their role in pain management. This shift in perception is expected to contribute to the growth of the Joint Pain Injection Market, as more patients seek out these effective solutions.