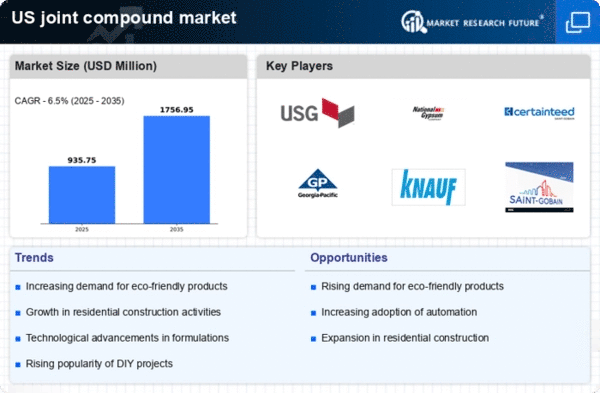

The joint compound market exhibits a dynamic competitive landscape characterized by a blend of innovation, strategic partnerships, and regional expansion. Key players such as USG Corporation (US), National Gypsum Company (US), and CertainTeed Corporation (US) are actively shaping the market through their distinct operational focuses. USG Corporation (US) emphasizes innovation in product development, particularly in eco-friendly formulations, which aligns with the growing demand for sustainable building materials. National Gypsum Company (US) has been enhancing its market presence through strategic acquisitions, thereby consolidating its position in the industry. Meanwhile, CertainTeed Corporation (US) is focusing on digital transformation initiatives to streamline operations and improve customer engagement, which collectively influences the competitive environment by fostering a culture of continuous improvement and responsiveness to market needs.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach not only enhances operational efficiency but also allows for better responsiveness to regional market demands. The market structure appears moderately fragmented, with several key players exerting influence while also facing competition from smaller, niche manufacturers. The collective actions of these major companies contribute to a competitive atmosphere that encourages innovation and efficiency.

In October USG Corporation (US) announced the launch of a new line of low-VOC joint compounds aimed at environmentally conscious consumers. This strategic move is significant as it not only addresses regulatory pressures but also aligns with the increasing consumer preference for sustainable products. By positioning itself as a leader in eco-friendly solutions, USG Corporation (US) is likely to enhance its market share and brand loyalty among environmentally aware customers.

In September National Gypsum Company (US) completed the acquisition of a regional competitor, which is expected to bolster its production capabilities and expand its distribution network. This acquisition is strategically important as it allows National Gypsum Company (US) to leverage synergies in operations and enhance its competitive edge in the market. The consolidation of resources may lead to improved cost efficiencies and a stronger market presence.

In August CertainTeed Corporation (US) launched a new digital platform designed to facilitate customer interactions and streamline order processing. This initiative reflects a broader trend towards digitalization in the industry, enabling CertainTeed Corporation (US) to enhance customer experience and operational efficiency. The integration of technology into business processes is likely to set a new standard for customer engagement in the joint compound market.

As of November current competitive trends are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances among key players are shaping the landscape, fostering innovation and collaborative solutions. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that companies that prioritize these aspects will likely emerge as leaders in the evolving market.