Emergence of Targeted Therapies

The emergence of targeted therapies is reshaping the landscape of the Japan radiopharmaceuticals market. These therapies, which utilize radiopharmaceuticals to deliver precise treatment to specific disease sites, are gaining traction due to their potential to improve patient outcomes while minimizing side effects. The Japanese healthcare system is increasingly adopting these innovative approaches, particularly in oncology, where targeted radiopharmaceuticals are being utilized to treat various types of cancer. This shift towards personalized medicine is supported by advancements in molecular imaging and biomarker identification, which enable healthcare providers to tailor treatments to individual patient profiles. As the demand for targeted therapies continues to grow, the Japan radiopharmaceuticals market is poised for expansion, driven by the need for more effective and personalized treatment options.

Growing Demand for Diagnostic Imaging

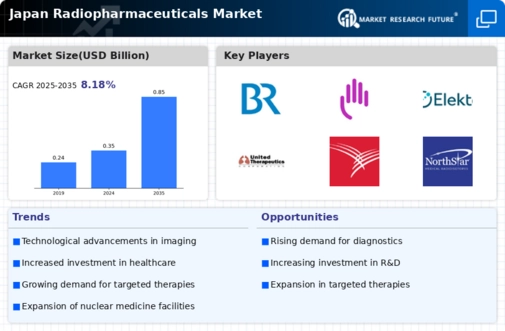

The Japan radiopharmaceuticals market is experiencing a notable increase in demand for diagnostic imaging procedures. This surge is primarily driven by the rising prevalence of chronic diseases, such as cancer and cardiovascular disorders, which necessitate advanced imaging techniques for accurate diagnosis. According to recent data, the market for diagnostic imaging in Japan is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This growth is likely to be fueled by the increasing adoption of positron emission tomography (PET) and single-photon emission computed tomography (SPECT) technologies, which utilize radiopharmaceuticals to enhance imaging clarity and precision. Consequently, the demand for radiopharmaceuticals is expected to rise, thereby propelling the overall growth of the Japan radiopharmaceuticals market.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the Japan radiopharmaceuticals market. The Japanese government, alongside private sector entities, is actively funding R&D initiatives aimed at developing novel radiopharmaceuticals and improving existing formulations. This commitment to innovation is evidenced by the allocation of substantial financial resources, with the Ministry of Health, Labour and Welfare (MHLW) supporting various projects that focus on enhancing the efficacy and safety of radiopharmaceuticals. Furthermore, collaborations between academic institutions and pharmaceutical companies are fostering the development of cutting-edge technologies, such as targeted radiotherapy. As a result, the R&D landscape in Japan is likely to yield new products that will not only meet the growing clinical needs but also expand the market potential of the Japan radiopharmaceuticals market.

Regulatory Framework and Approval Processes

The regulatory framework governing the Japan radiopharmaceuticals market plays a pivotal role in shaping its growth trajectory. The Pharmaceuticals and Medical Devices Agency (PMDA) in Japan has established a comprehensive regulatory environment that facilitates the approval of new radiopharmaceuticals. This framework is designed to ensure the safety and efficacy of radiopharmaceuticals while also expediting the approval process for innovative products. Recent initiatives aimed at streamlining regulatory pathways have resulted in faster market access for new radiopharmaceuticals, thereby encouraging investment and innovation within the industry. As a result, the Japan radiopharmaceuticals market is likely to witness an influx of new products that cater to the evolving needs of healthcare providers and patients alike.

Aging Population and Increased Healthcare Expenditure

Japan's aging population is a significant driver of the radiopharmaceuticals market. With a demographic shift towards an older population, there is an increasing incidence of age-related diseases, which necessitates advanced diagnostic and therapeutic solutions. The Japanese government has recognized this trend and is increasing healthcare expenditure to accommodate the growing healthcare needs of its citizens. In 2025, healthcare spending in Japan is projected to reach approximately 42 trillion yen, reflecting a commitment to improving healthcare services. This increase in expenditure is likely to enhance access to radiopharmaceuticals, as healthcare providers invest in advanced imaging technologies and treatments. Consequently, the Japan radiopharmaceuticals market stands to benefit from this demographic trend, as the demand for effective diagnostic and therapeutic options continues to rise.