Government Initiatives and Support

The role of government initiatives in The India Radiopharmaceuticals Market cannot be overstated. The Indian government has implemented various policies aimed at promoting research and development in the field of nuclear medicine. For example, the Department of Atomic Energy (DAE) has been actively involved in supporting the establishment of radiopharmaceutical production facilities across the country. Additionally, the government has introduced regulatory frameworks that facilitate the approval process for new radiopharmaceuticals, thereby encouraging innovation. Financial incentives and grants for research projects are also available, fostering collaboration between public and private sectors. These initiatives are expected to bolster the market, with projections indicating a potential increase in market size to USD 1.5 billion by 2028, driven by enhanced production capabilities and regulatory support.

Rising Demand for Targeted Therapies

The increasing prevalence of chronic diseases, particularly cancer, is driving the demand for targeted therapies within The India Radiopharmaceuticals Market. As healthcare providers seek more effective treatment options, radiopharmaceuticals that specifically target tumor cells are gaining popularity. This shift towards personalized medicine is reflected in the growing number of clinical trials focusing on radioligand therapies and other targeted approaches. According to recent estimates, the market for targeted radiopharmaceuticals is expected to reach USD 800 million by 2026, highlighting the significant investment in this area. Moreover, the rising awareness among patients and healthcare professionals regarding the benefits of targeted therapies is likely to further propel market growth. This trend indicates a shift in treatment paradigms, emphasizing the importance of precision medicine in oncology.

Growing Investment in Research and Development

Investment in research and development (R&D) is a critical driver for The India Radiopharmaceuticals Market. Pharmaceutical companies and research institutions are increasingly allocating resources to develop new radiopharmaceuticals and improve existing ones. This focus on R&D is essential for addressing the unmet medical needs in oncology and other therapeutic areas. The Indian government, along with private sector players, is fostering an environment conducive to innovation through funding and collaboration. For instance, partnerships between academic institutions and industry stakeholders are becoming more common, facilitating knowledge transfer and accelerating the development process. As a result, the market is anticipated to witness a surge in new product launches, contributing to an estimated market value of USD 1.2 billion by 2027, driven by innovative therapies and enhanced treatment options.

Technological Advancements in Radiopharmaceuticals

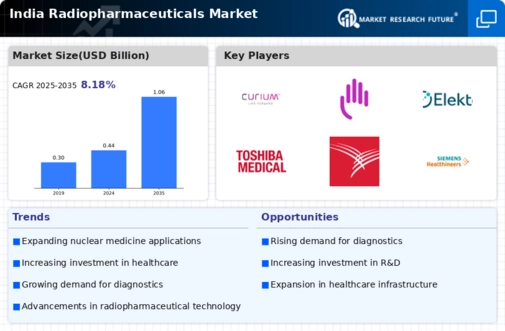

The India Radiopharmaceuticals Market is experiencing a notable transformation due to rapid technological advancements. Innovations in imaging techniques, such as PET and SPECT, have enhanced the precision of diagnostics and treatment. The introduction of novel radiopharmaceuticals, including those targeting specific cancer types, is expanding therapeutic options. For instance, the development of radioligand therapy is gaining traction, potentially improving patient outcomes. Furthermore, advancements in production technologies, such as automated synthesis and quality control, are streamlining the manufacturing process. This not only ensures the availability of high-quality products but also reduces costs, making treatments more accessible. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years, reflecting the increasing integration of technology in the field.

Increasing Awareness and Acceptance of Nuclear Medicine

The growing awareness and acceptance of nuclear medicine among healthcare professionals and patients are pivotal for The India Radiopharmaceuticals Market. Educational initiatives and outreach programs are being implemented to inform stakeholders about the benefits and applications of radiopharmaceuticals. As more healthcare providers recognize the advantages of nuclear medicine in diagnostics and treatment, the demand for these therapies is likely to rise. Furthermore, patient advocacy groups are playing a crucial role in promoting awareness, leading to increased acceptance of radiopharmaceuticals as viable treatment options. This shift in perception is expected to contribute to market growth, with projections indicating a potential market size of USD 1 billion by 2026. The increasing integration of nuclear medicine into standard treatment protocols underscores its importance in modern healthcare.