Regulatory Framework Enhancements

The GCC radiopharmaceuticals market is witnessing a transformation due to the enhancement of regulatory frameworks governing the use of radiopharmaceuticals. Regulatory bodies in the region are increasingly adopting international standards to ensure the safety and efficacy of radiopharmaceutical products. For example, the Saudi Food and Drug Authority (SFDA) has implemented stringent guidelines for the approval and monitoring of radiopharmaceuticals, which has fostered a more reliable market environment. This regulatory support not only instills confidence among manufacturers and healthcare providers but also encourages investment in research and development of new radiopharmaceuticals. As a result, the GCC radiopharmaceuticals market is likely to see an influx of innovative products that meet the evolving needs of healthcare professionals and patients alike. The alignment with global regulatory practices may also facilitate easier access to international markets for GCC-based radiopharmaceutical manufacturers.

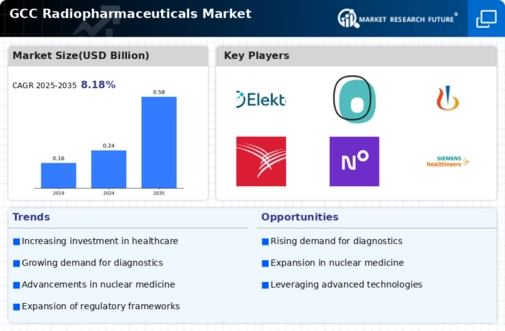

Growing Demand for Diagnostic Imaging

The GCC radiopharmaceuticals market is experiencing a notable increase in demand for diagnostic imaging procedures. This surge is primarily driven by the rising prevalence of chronic diseases, such as cancer and cardiovascular disorders, which necessitate advanced imaging techniques for accurate diagnosis and treatment planning. According to recent statistics, the GCC region has witnessed a 15% annual growth in the utilization of PET scans, a key application of radiopharmaceuticals. This trend indicates a shift towards more precise diagnostic tools, thereby enhancing patient outcomes. Furthermore, the increasing awareness among healthcare professionals and patients regarding the benefits of early disease detection is likely to further propel the demand for radiopharmaceuticals in the GCC market. As healthcare systems evolve, the integration of innovative imaging technologies will play a crucial role in shaping the future of the GCC radiopharmaceuticals market.

Investment in Healthcare Infrastructure

The GCC radiopharmaceuticals market is poised for growth due to substantial investments in healthcare infrastructure across the region. Governments in GCC countries are prioritizing the enhancement of healthcare facilities, which includes the establishment of advanced imaging centers equipped with state-of-the-art radiopharmaceutical technologies. For instance, the UAE has allocated over USD 2 billion for healthcare infrastructure development, which encompasses the expansion of diagnostic imaging capabilities. This investment is expected to facilitate the adoption of radiopharmaceuticals, as healthcare providers seek to improve diagnostic accuracy and patient care. Additionally, the establishment of specialized training programs for healthcare professionals in the use of radiopharmaceuticals is likely to enhance the overall competency within the sector. As a result, the GCC radiopharmaceuticals market is likely to benefit from a more robust healthcare framework that supports the integration of innovative diagnostic solutions.

Rising Awareness of Personalized Medicine

The GCC radiopharmaceuticals market is increasingly influenced by the rising awareness of personalized medicine among healthcare providers and patients. Personalized medicine, which tailors treatment based on individual patient characteristics, is gaining traction in the region, particularly in oncology. Radiopharmaceuticals play a pivotal role in this approach by enabling targeted therapies that enhance treatment efficacy while minimizing side effects. The GCC region has seen a growing number of clinical trials focusing on personalized radiopharmaceuticals, with several institutions collaborating to develop innovative solutions. This trend is likely to drive the demand for radiopharmaceuticals, as healthcare providers seek to offer more effective and individualized treatment options. Furthermore, the integration of radiopharmaceuticals into personalized medicine frameworks may lead to improved patient outcomes, thereby reinforcing the importance of the GCC radiopharmaceuticals market in the broader healthcare landscape.

Technological Innovations in Radiopharmaceuticals

The GCC radiopharmaceuticals market is significantly benefiting from technological innovations that enhance the production and application of radiopharmaceuticals. Advances in radiochemistry and imaging technologies are enabling the development of novel radiopharmaceuticals with improved efficacy and safety profiles. For instance, the introduction of automated synthesis modules has streamlined the production process, ensuring consistent quality and reducing production costs. Additionally, the integration of artificial intelligence in imaging analysis is enhancing the precision of diagnostic procedures, thereby increasing the demand for radiopharmaceuticals. As these technologies continue to evolve, they are likely to create new opportunities within the GCC radiopharmaceuticals market. The ongoing collaboration between academic institutions and industry players is expected to further accelerate innovation, leading to the emergence of cutting-edge radiopharmaceutical products that meet the growing needs of healthcare providers and patients.