Rising Health Consciousness

The organic natural-feminine-care market in Japan is experiencing a notable surge in demand driven by an increasing awareness of health and wellness among consumers. This trend is characterized by a shift towards products that are perceived as safer and more beneficial for personal health. According to recent surveys, approximately 70% of Japanese women express a preference for organic products, indicating a strong inclination towards natural ingredients. This heightened health consciousness is influencing purchasing decisions, as consumers seek products that align with their values of sustainability and well-being. The organic natural-feminine-care market is thus positioned to benefit from this growing demographic that prioritizes health, potentially leading to a market growth rate of around 15% annually in the coming years.

Cultural Shift Towards Natural Products

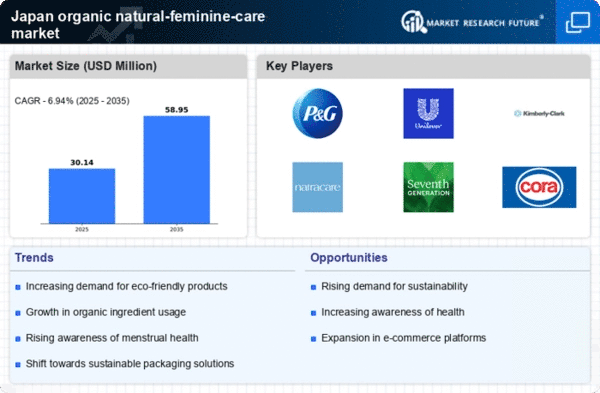

In Japan, there is a significant cultural shift towards embracing natural and organic products, which is profoundly impacting the organic natural-feminine-care market. This shift is partly influenced by traditional Japanese practices that emphasize natural remedies and holistic approaches to health. As consumers become more educated about the benefits of organic ingredients, the demand for products free from synthetic chemicals is rising. Market data suggests that the organic natural-feminine-care market could see an increase in sales by 20% over the next five years, as more brands introduce innovative products that cater to this growing preference. This cultural evolution reflects a broader societal trend towards sustainability and environmental consciousness.

Regulatory Support for Organic Products

The Japanese government is actively promoting organic agriculture and products, which is positively influencing the organic natural-feminine-care market. Recent policies aimed at supporting organic farming practices and increasing consumer awareness about organic certifications are creating a favorable environment for market growth. The government has set ambitious targets to increase the share of organic products in the overall market, which could lead to a projected growth of 10% in the organic natural-feminine-care market by 2027. This regulatory support not only enhances consumer trust but also encourages manufacturers to invest in organic product development, thereby expanding the market landscape.

Growing Demand for Eco-Friendly Packaging

The organic natural-feminine-care market in Japan is increasingly influenced by consumer demand for eco-friendly packaging solutions. As environmental concerns become more prominent, consumers are actively seeking products that not only contain organic ingredients but also utilize sustainable packaging materials. This trend is reflected in Market Research Future indicating that over 60% of consumers prefer brands that prioritize environmentally friendly packaging. Consequently, manufacturers are adapting their packaging strategies to align with these preferences, which could lead to a potential market growth of 12% in the organic natural-feminine-care sector over the next few years. This shift towards sustainability in packaging is likely to enhance brand loyalty and attract environmentally conscious consumers.

Influence of Social Media and Digital Marketing

The rise of social media and digital marketing is transforming the way consumers engage with the organic natural-feminine-care market in Japan. Brands are leveraging platforms like Instagram and Twitter to reach a broader audience, showcasing the benefits of their organic products through influencer partnerships and targeted advertising. This digital engagement is particularly effective among younger consumers, who are more likely to seek out and trust recommendations from social media influencers. As a result, the organic natural-feminine-care market is witnessing a shift in marketing strategies, with an estimated 30% increase in online sales attributed to these digital initiatives. This trend suggests that brands that effectively utilize social media may capture a larger share of the market.