Consumer Awareness of Ingredients

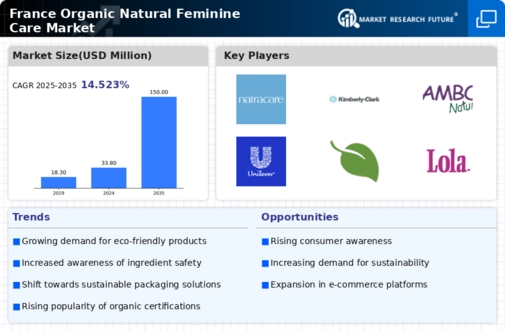

In recent years, there has been a marked increase in consumer awareness regarding the ingredients used in feminine care products. This trend is particularly pronounced in the organic natural-feminine-care market, where consumers are increasingly scrutinizing product labels for harmful chemicals and synthetic additives. According to recent surveys, approximately 70% of French consumers express a preference for products with natural ingredients. This heightened awareness drives demand for transparency and encourages brands to disclose their ingredient sourcing and manufacturing processes. As a result, companies that prioritize clean, organic formulations are likely to gain a competitive edge in the organic natural-feminine-care market, appealing to health-conscious consumers who seek safer alternatives for personal care.

Rising Interest in Holistic Health

There is a growing interest in holistic health and wellness among consumers in France, which significantly influences the organic natural-feminine-care market. This trend reflects a broader shift towards natural and alternative health solutions, with consumers seeking products that align with their overall well-being. Research indicates that approximately 65% of French women are inclined to choose organic feminine care products that promote not only physical health but also emotional and mental well-being. This holistic approach encourages brands to develop products that incorporate natural ingredients known for their therapeutic properties. Consequently, companies that align their offerings with this holistic health trend are likely to capture a larger share of the organic natural-feminine-care market.

Shift Towards Eco-Friendly Packaging

The organic natural-feminine-care market is experiencing a significant shift towards eco-friendly packaging solutions. As environmental concerns become more pressing, consumers are increasingly favoring brands that utilize sustainable materials for their product packaging. In France, studies indicate that over 60% of consumers are willing to pay a premium for products that come in biodegradable or recyclable packaging. This trend not only reflects a growing commitment to sustainability but also influences purchasing decisions, as consumers seek to minimize their ecological footprint. Brands that adopt innovative packaging solutions, such as compostable materials or refillable containers, are likely to resonate with environmentally conscious consumers, thereby enhancing their market presence in the organic natural-feminine-care market.

Regulatory Support for Organic Products

Regulatory frameworks in France are increasingly supportive of organic products, which positively impacts the organic natural-feminine-care market. The French government has implemented various initiatives to promote organic farming and sustainable practices, including subsidies and certifications for organic products. This regulatory support not only encourages manufacturers to adopt organic practices but also instills consumer confidence in the safety and efficacy of organic feminine care products. As a result, the organic natural-feminine-care market is likely to benefit from a growing number of certified organic products, appealing to consumers who prioritize quality and sustainability in their purchasing decisions.

Influence of Social Media and Influencers

The role of social media and influencers in shaping consumer preferences cannot be overstated, particularly in the organic natural-feminine-care market. Platforms like Instagram and TikTok have become vital channels for brands to engage with their audience and promote their products. Influencers who advocate for natural and organic lifestyles significantly impact purchasing decisions, with studies showing that 50% of consumers in France are influenced by social media recommendations. This dynamic creates opportunities for brands to leverage influencer partnerships to enhance visibility and credibility. As a result, companies that effectively utilize social media marketing strategies are likely to thrive in the competitive landscape of the organic natural-feminine-care market.