Increased Research Funding

The Japan microarray market benefits from a notable increase in research funding from both governmental and private sectors. The Japanese government has prioritized biotechnology and genomics research, allocating substantial budgets to support innovative projects. In 2025, funding for life sciences research reached an estimated 500 billion yen, with a significant portion directed towards microarray technology development. This influx of financial resources is likely to facilitate the establishment of advanced research facilities and foster collaborations between academic institutions and industry players. As a result, the Japan microarray market is poised for growth, as researchers gain access to state-of-the-art tools and resources necessary for groundbreaking discoveries. The emphasis on research funding underscores the commitment to advancing the field of genomics and personalized medicine in Japan.

Rising Awareness of Genetic Testing

The Japan microarray market is experiencing a surge in awareness regarding genetic testing among healthcare professionals and the general public. Educational campaigns and initiatives by health organizations have contributed to a better understanding of the benefits of genetic testing in disease prevention and management. As of January 2026, the market for genetic testing in Japan is estimated to exceed 300 billion yen, with microarray technologies playing a pivotal role in this growth. This heightened awareness is likely to lead to increased demand for microarray-based diagnostic tools, as patients and clinicians seek more accurate and comprehensive testing options. Consequently, the Japan microarray market stands to benefit from this trend, as it aligns with the broader movement towards precision medicine and proactive healthcare.

Growing Demand for Personalized Medicine

The Japan microarray market is witnessing a growing demand for personalized medicine, which is reshaping healthcare delivery. As healthcare providers increasingly recognize the importance of tailoring treatments to individual patients, microarray technologies play a crucial role in identifying genetic variations that influence drug responses. The market for personalized medicine in Japan is projected to reach 1 trillion yen by 2027, indicating a substantial opportunity for microarray applications in pharmacogenomics and diagnostics. This trend is further supported by the rising prevalence of chronic diseases, necessitating more precise and effective treatment strategies. Consequently, the Japan microarray market is likely to expand as healthcare systems integrate microarray technologies into routine clinical practice, enhancing patient outcomes and optimizing therapeutic interventions.

Regulatory Support and Policy Initiatives

The Japan microarray market is bolstered by supportive regulatory frameworks and policy initiatives aimed at promoting biotechnology innovation. The Pharmaceuticals and Medical Devices Agency (PMDA) has implemented streamlined approval processes for microarray-based diagnostic tools, facilitating quicker market entry for new products. Additionally, the government has introduced initiatives to encourage public-private partnerships in research and development, fostering collaboration between academia and industry. These policies are expected to enhance the competitiveness of the Japan microarray market on a global scale. As of January 2026, the regulatory environment appears conducive to innovation, potentially attracting foreign investments and encouraging local startups to develop novel microarray solutions. This supportive landscape is likely to drive growth and enhance the overall market dynamics.

Technological Advancements in Microarray Technology

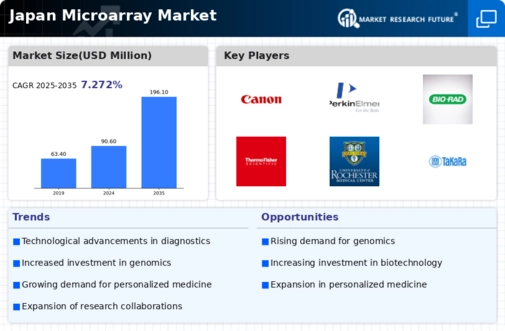

The Japan microarray market is experiencing rapid technological advancements that enhance the capabilities of microarray platforms. Innovations such as high-throughput screening and improved data analysis software are driving the market forward. For instance, the introduction of next-generation sequencing technologies has significantly increased the accuracy and efficiency of microarray applications. As of January 2026, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10%, reflecting the increasing adoption of these advanced technologies. Furthermore, the integration of artificial intelligence in data interpretation is likely to streamline research processes, making microarrays more accessible to researchers and clinicians alike. This trend indicates a robust future for the Japan microarray market, as it continues to evolve with cutting-edge technologies.