Cultural Acceptance of Herbal Remedies

The cultural acceptance of herbal remedies in Japan plays a pivotal role in shaping the herbal medicine market. Traditional practices, such as Kampo, which utilizes herbal formulations, have been integrated into mainstream healthcare. This acceptance is reflected in the increasing consumer preference for natural products, with approximately 60% of the population expressing a preference for herbal solutions over synthetic alternatives. The herbal medicine market benefits from this cultural inclination, as it fosters a growing demand for products that align with traditional values. Furthermore, the rise of wellness trends emphasizes holistic approaches, further solidifying the position of herbal remedies in the health and wellness sector. As consumers become more health-conscious, the market is likely to expand, driven by a desire for natural and culturally resonant healthcare solutions.

Regulatory Support for Herbal Products

Regulatory support for herbal products in Japan significantly influences the herbal medicine market. The Japanese government has established guidelines that promote the safe use of herbal medicines, ensuring quality and efficacy. This regulatory framework encourages manufacturers to adhere to stringent standards, thereby enhancing consumer trust. In recent years, the herbal medicine market has witnessed a surge in product approvals, with a reported increase of 25% in new herbal formulations entering the market. This supportive environment not only facilitates innovation but also attracts investment in research and development. As regulations continue to evolve, they are likely to create new opportunities for growth, allowing the market to expand further while maintaining safety and efficacy standards.

Increased Availability of Herbal Products

The increased availability of herbal products in Japan is a crucial factor driving the herbal medicine market. Retail channels, including pharmacies, health food stores, and online platforms, have expanded their offerings of herbal remedies, making them more accessible to consumers. Recent data indicates that online sales of herbal products have surged by 30%, reflecting a shift in consumer purchasing behavior. This trend is particularly relevant among younger demographics who prefer the convenience of online shopping. The herbal medicine market benefits from this enhanced accessibility, as it allows for a broader reach and the potential to attract new customers. As distribution channels continue to diversify, the market is likely to experience sustained growth, driven by increased consumer access to a variety of herbal solutions.

Rising Health Consciousness Among Consumers

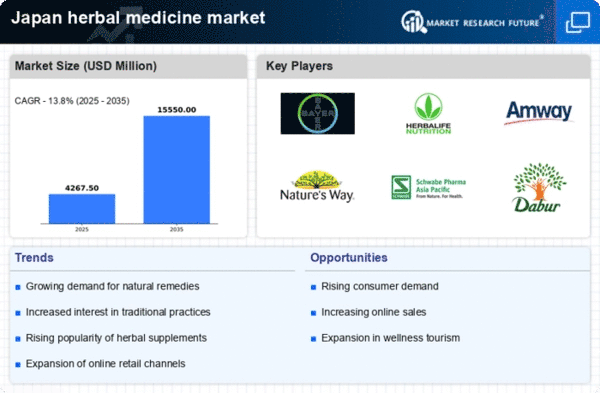

Rising health consciousness among consumers is a prominent driver of the herbal medicine market. As individuals become more aware of the impact of lifestyle choices on health, there is a growing inclination towards natural and organic products. This trend is reflected in the increasing demand for herbal supplements and remedies, with Market Research Future indicating a growth rate of 20% in the past year alone. The herbal medicine market is poised to benefit from this heightened awareness, as consumers actively seek alternatives to conventional pharmaceuticals. Furthermore, the emphasis on mental and physical well-being has led to a surge in interest in herbal solutions that promote relaxation and stress relief. This shift in consumer mindset is likely to sustain market growth, as more individuals prioritize their health and wellness through the use of herbal products.

Growing Interest in Preventive Health Solutions

The growing interest in preventive health solutions is a significant driver for the herbal medicine market. As consumers increasingly prioritize health maintenance over treatment, there is a notable shift towards natural remedies that promote overall well-being. This trend is evident in the rising sales of herbal supplements, which have seen an annual growth rate of approximately 15% in recent years. The herbal medicine market is well-positioned to capitalize on this shift, as products that support immune function and general health are in high demand. Additionally, educational campaigns highlighting the benefits of preventive care are likely to further enhance consumer awareness and acceptance of herbal solutions. This focus on prevention may lead to a sustained increase in market growth as more individuals seek to incorporate herbal remedies into their daily health regimens.