E-commerce Expansion

The expansion of e-commerce platforms is transforming the herbal medicine market in India. With the rise of online shopping, consumers now have greater access to a wide range of herbal products. E-commerce allows for convenient purchasing options, enabling consumers to explore various brands and products from the comfort of their homes. Recent data indicates that online sales of herbal products have increased by 40% in the past year, reflecting a shift in consumer purchasing behavior. This trend is likely to continue, as more consumers embrace digital platforms for their shopping needs, thereby driving growth in the herbal medicine market.

Growing Consumer Awareness

The herbal medicine market in India is experiencing a notable surge in consumer awareness regarding the benefits of natural remedies. As individuals become increasingly informed about the potential side effects of synthetic drugs, there is a shift towards herbal alternatives. This trend is supported by various health campaigns and educational initiatives that emphasize the efficacy of herbal treatments. According to recent surveys, approximately 70% of consumers express a preference for herbal products over conventional pharmaceuticals. This growing awareness is likely to drive demand within the herbal medicine market, as consumers seek safer and more holistic approaches to health and wellness.

Rising Health Consciousness

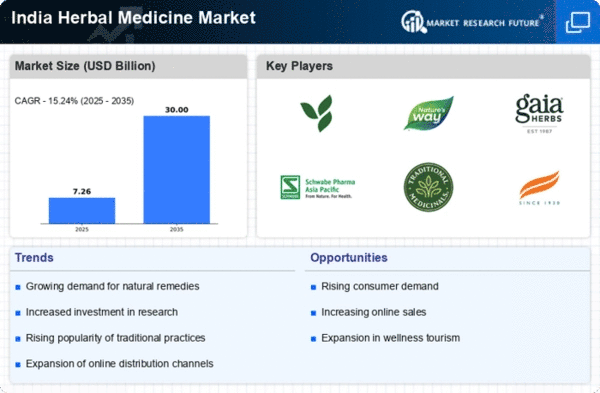

The increasing health consciousness among the Indian population significantly impacts the herbal medicine market. As lifestyle-related diseases become more prevalent, individuals are actively seeking preventive measures and natural solutions. Reports suggest that the herbal medicine market is projected to grow at a CAGR of 15% from 2025 to 2030, driven by this health-oriented mindset. Consumers are increasingly turning to herbal supplements and remedies to enhance their overall well-being, indicating a shift towards preventive healthcare. This trend is likely to bolster the market as more individuals prioritize health and wellness in their daily lives.

Innovation in Product Development

Innovation within the herbal medicine market is a crucial driver of growth in India. Companies are increasingly investing in research and development to create new formulations and delivery methods that enhance the efficacy of herbal products. This includes the development of herbal supplements, teas, and topical applications that cater to diverse consumer needs. The introduction of standardized herbal products, backed by scientific research, is likely to attract a broader audience. As a result, the market is expected to witness a rise in product offerings, which could potentially lead to increased consumer trust and market expansion.

Cultural Acceptance of Herbal Practices

Cultural acceptance plays a pivotal role in shaping the herbal medicine market in India. Traditional practices, such as Ayurveda and Siddha, have been integral to Indian culture for centuries. This deep-rooted acceptance fosters a favorable environment for the growth of herbal products. Recent studies indicate that around 60% of the population regularly utilizes herbal remedies, reflecting a strong cultural inclination towards these practices. The herbal medicine market benefits from this cultural heritage, as consumers are more inclined to trust and adopt products that align with their traditional beliefs and practices, thereby enhancing market growth.