Increased Internet Penetration

Japan's fiber optic-components market is significantly influenced by the increasing internet penetration across the country. With over 90% of households having internet access, the demand for high-speed connectivity is at an all-time high. This has led to a substantial investment in fiber optic infrastructure, as service providers aim to meet consumer expectations for faster and more reliable internet services. The fiber optic-components market is projected to benefit from this trend, with an expected growth rate of around 7% annually. As more businesses and individuals rely on digital services, the need for robust fiber optic solutions becomes increasingly critical, further propelling market expansion.

Focus on Smart City Initiatives

Japan's commitment to developing smart cities is significantly impacting the fiber optic-components market. These initiatives aim to enhance urban living through technology, requiring robust communication networks. Fiber optic components are essential for the infrastructure of smart cities, facilitating efficient data transfer for various applications, including traffic management and public safety. The government has allocated substantial funding for these projects, which is likely to drive market growth by an estimated 8% over the next few years. As cities become more interconnected, the demand for advanced fiber optic solutions will continue to rise, further solidifying the importance of the fiber optic-components market.

Growing Demand from Data Centers

The fiber optic-components market in Japan is also being driven by the growing demand from data centers. As cloud computing and big data analytics gain traction, data centers require high-speed, reliable connectivity to handle vast amounts of data. Fiber optic technology is preferred due to its superior bandwidth capabilities and lower latency. The market for fiber optic components is expected to expand by approximately 9% as data centers increasingly adopt fiber optics for their infrastructure. This trend highlights the critical role that fiber optic technology plays in supporting the digital economy, making it a vital component of the fiber optic-components market.

Rising Adoption in Telecommunications

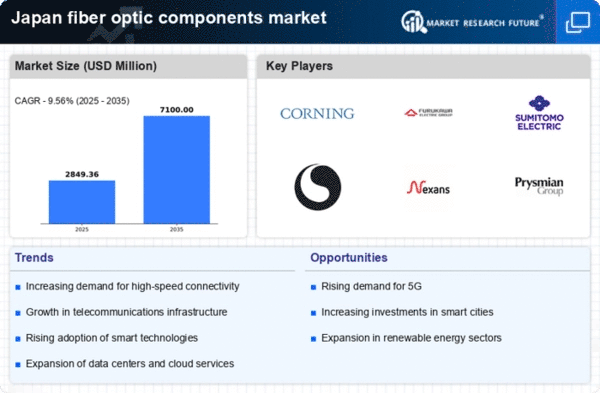

The telecommunications sector in Japan is a major driver for the fiber optic-components market. As mobile and broadband services evolve, there is a growing need for high-capacity fiber optic networks to support data transmission. The Japanese government has been promoting the expansion of 5G networks, which rely heavily on fiber optic technology. This initiative is expected to create a demand surge for fiber optic components, with estimates suggesting a market growth of 10% in the coming years. Telecommunications companies are investing heavily in upgrading their infrastructure, which directly benefits the fiber optic-components market by increasing the demand for advanced components.

Technological Advancements in Fiber Optics

The fiber optic-components market in Japan is experiencing a surge due to rapid technological advancements. Innovations in manufacturing processes and materials have led to the development of more efficient and durable fiber optic components. For instance, the introduction of bend-insensitive fibers has improved installation flexibility and performance. As of 2025, the market is projected to grow at a CAGR of approximately 8.5%, driven by these advancements. Furthermore, the integration of advanced technologies such as AI and IoT in fiber optic systems enhances their capabilities, making them more appealing to various sectors. This trend indicates a robust future for the fiber optic-components market, as companies invest in R&D to stay competitive.