Expansion of Smart Cities

The development of smart cities in France is driving the fiber optic-components market. As urban areas evolve to incorporate advanced technologies, the need for efficient communication networks becomes paramount. Fiber optic technology is essential for supporting the infrastructure of smart cities, which rely on real-time data transmission for services such as traffic management, public safety, and energy efficiency. The French government has allocated substantial funding for smart city initiatives, indicating a commitment to modernizing urban infrastructure. This investment is expected to create a robust demand for fiber optic components, as they are integral to the connectivity required for smart city applications. The fiber optic-components market is likely to see increased activity as municipalities partner with technology providers to implement these solutions, thereby enhancing urban living conditions and operational efficiencies.

Focus on Enhanced Network Security

The emphasis on enhanced network security in France is emerging as a crucial driver for the fiber optic-components market. As cyber threats become more sophisticated, organizations are prioritizing secure communication channels to protect sensitive data. Fiber optic technology offers inherent advantages in terms of security, as it is less susceptible to interception compared to traditional copper cables. This growing awareness of cybersecurity risks is prompting businesses and government entities to invest in fiber optic infrastructure. The fiber optic-components market is likely to benefit from this trend, as organizations seek to implement secure communication solutions that safeguard their operations. With the increasing focus on data protection, the demand for fiber optic components is expected to rise, reflecting the broader commitment to enhancing network security across various sectors.

Growth in Telecommunications Sector

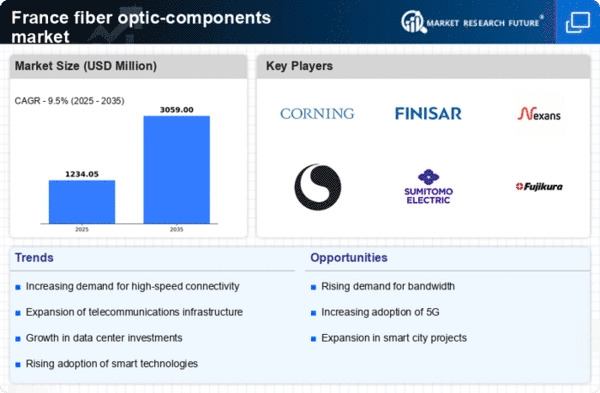

The telecommunications sector in France is experiencing notable growth, which serves as a significant driver for the fiber optic-components market. With the ongoing rollout of 5G technology, telecommunications companies are investing heavily in fiber optic infrastructure to support the increased data demands associated with next-generation networks. Reports indicate that the telecommunications industry in France is projected to grow by approximately 10% over the next few years, driven by the need for faster and more reliable communication services. This growth necessitates the deployment of fiber optic components, which are essential for achieving the high-speed connectivity required for 5G networks. As telecommunications providers expand their services, the fiber optic-components market is likely to benefit from increased demand for innovative solutions that enhance network performance and reliability.

Increased Investment in Data Centers

The rising demand for data storage and processing capabilities in France is propelling investment in data centers, which in turn drives the fiber optic-components market. As businesses increasingly rely on cloud computing and big data analytics, the need for efficient data centers equipped with high-speed connectivity becomes critical. Recent statistics suggest that the data center market in France is expected to grow by over 12% annually, reflecting the increasing reliance on digital services. Fiber optic technology is vital for ensuring rapid data transfer and minimizing latency within these facilities. Consequently, The fiber optic-components market is likely to see heightened activity. This is due to data center operators seeking to enhance their infrastructure with advanced fiber optic solutions, thereby supporting the growing digital economy.

Rising Demand for High-Speed Internet

The increasing demand for high-speed internet in France is a primary driver for the fiber optic-components market. As more consumers and businesses seek faster and more reliable internet connections, the need for advanced fiber optic technology becomes evident. According to recent data, the number of fiber optic subscriptions in France has surged, with a growth rate of approximately 15% annually. This trend is likely to continue as digital services expand, necessitating robust infrastructure. The fiber optic-components market is poised to benefit from this demand, as service providers invest in upgrading their networks to meet consumer expectations. Enhanced connectivity is not only crucial for residential users but also for enterprises that rely on high-speed data transfer for operations. Thus, the rising demand for high-speed internet significantly propels the growth of the fiber optic-components market in France.