Surge in Data Traffic

The surge in data traffic across the GCC is another critical driver influencing the fiber optic-components market. With the proliferation of smart devices and the increasing reliance on cloud-based services, data consumption is escalating at an unprecedented rate. Reports indicate that data traffic in the region is expected to increase by over 30% annually, necessitating robust infrastructure to support this growth. Fiber optic components, known for their high bandwidth capabilities, are essential in managing this influx of data. As businesses and consumers alike demand faster and more reliable internet services, the fiber optic-components market is poised for substantial growth to accommodate these needs.

Focus on Smart City Developments

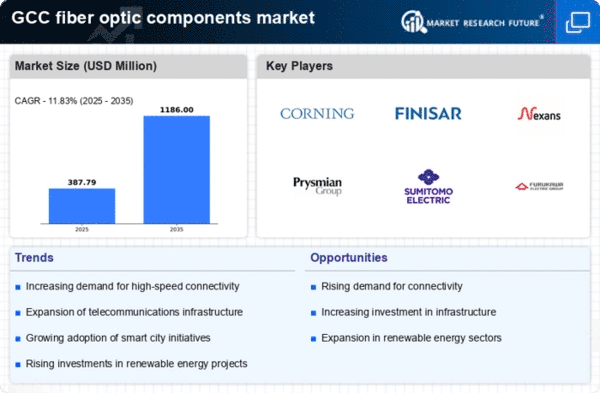

The focus on smart city developments within the GCC is driving the demand for these components. Governments in the region are increasingly investing in smart city initiatives, which rely heavily on advanced communication technologies. Fiber optic networks are integral to the infrastructure of smart cities, enabling efficient data transmission for various applications such as traffic management, public safety, and energy efficiency. As these projects gain momentum, the fiber optic-components market is likely to experience a corresponding increase in demand. The integration of fiber optics into smart city frameworks not only enhances connectivity but also supports the overall vision of sustainable urban development.

Increased Investment in Renewable Energy

Increased investment in renewable energy projects across the GCC is emerging as a significant driver for the fiber optic-components market. As countries in the region strive to diversify their energy sources and reduce reliance on fossil fuels, the development of renewable energy infrastructure is gaining traction. Fiber optic technology plays a crucial role in monitoring and managing renewable energy systems, such as solar and wind farms. The market for renewable energy in the GCC is expected to witness a growth rate of approximately 15% annually, creating a demand for advanced communication solutions. Consequently, the fiber optic-components market is likely to benefit from this shift towards sustainable energy practices.

Rising Adoption of Internet of Things (IoT)

The rising adoption of Internet of Things (IoT) technologies in the GCC is significantly impacting the fiber optic-components market. As industries increasingly integrate IoT solutions to enhance operational efficiency and data analytics, the need for reliable and high-speed connectivity becomes paramount. Fiber optic components are essential for supporting the vast networks of interconnected devices, ensuring seamless communication and data transfer. The market for IoT in the GCC is projected to grow substantially, with estimates suggesting a potential increase of over 25% by 2027. This trend indicates a robust opportunity for the fiber optic-components market to expand in tandem with the growing IoT ecosystem.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure in the GCC region is a primary driver for the fiber optic components market. As countries within the GCC invest heavily in modernizing their communication networks, the demand for fiber optic components is expected to rise significantly. For instance, the telecommunications sector in the GCC is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth is largely attributed to the increasing need for high-speed internet and reliable communication services. Consequently, the fiber optic-components market is likely to benefit from this trend, as service providers seek to enhance their offerings and meet the growing consumer demand for faster and more efficient connectivity.