Aging Infrastructure

Aging infrastructure presents a pressing challenge and a driver in the Japan facility management market. Many facilities in Japan are facing the consequences of aging buildings and systems, which can lead to increased maintenance costs and safety concerns. The government has recognized this issue and is investing in infrastructure renewal projects, which creates opportunities for facility management companies. The need for modernization and refurbishment of existing facilities is becoming paramount, as organizations seek to enhance operational efficiency and ensure safety. Facility management providers are likely to play a crucial role in these initiatives by offering services such as facility assessments, renovation planning, and ongoing maintenance. This trend indicates a growing market for facility management solutions that address the challenges posed by aging infrastructure.

Regulatory Compliance

Regulatory compliance is a significant driver in the Japan facility management market. The Japanese government has established stringent regulations regarding building safety, environmental standards, and labor laws. Facility management companies must navigate these complex regulations to ensure compliance and avoid penalties. For instance, the Building Standards Act mandates specific safety measures that must be adhered to in facility operations. This regulatory landscape creates a demand for specialized facility management services that can assist organizations in maintaining compliance. Companies are increasingly seeking partners who possess expertise in navigating these regulations, which may include safety audits, environmental assessments, and training programs. As regulations evolve, the need for compliance-focused facility management solutions is expected to grow.

Technological Integration

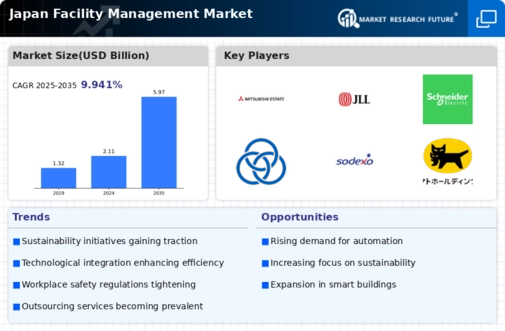

Technological integration is a pivotal driver in the Japan facility management market. The adoption of advanced technologies such as IoT, AI, and big data analytics is transforming how facilities are managed. These technologies enable real-time monitoring of building systems, predictive maintenance, and enhanced operational efficiency. According to recent data, the market for smart building technologies in Japan is expected to reach substantial figures by 2026, reflecting a growing trend towards automation and data-driven decision-making. Facility management companies are increasingly investing in technology to provide better services, improve tenant experiences, and optimize resource allocation. This trend not only enhances operational efficiency but also aligns with the broader goals of sustainability and cost reduction.

Sustainability Initiatives

The Japan facility management market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, organizations are adopting eco-friendly practices to reduce their carbon footprint. The Japanese government has implemented various policies aimed at promoting energy efficiency and waste reduction. For instance, the Act on the Rational Use of Energy encourages businesses to adopt energy-saving technologies. This has led to a growing demand for facility management services that prioritize sustainable practices. Companies are now seeking providers that can help them achieve their sustainability goals, which may include waste management, energy audits, and green building certifications. The market for green building materials and services is projected to grow significantly, indicating a shift towards more sustainable facility management solutions.

Focus on Employee Well-being

The focus on employee well-being is becoming a crucial driver in the Japan facility management market. Organizations are recognizing the importance of creating healthy and conducive work environments to enhance productivity and employee satisfaction. This shift is reflected in the increasing demand for facility management services that prioritize wellness features, such as improved air quality, ergonomic designs, and access to natural light. Recent surveys indicate that companies investing in employee well-being initiatives experience lower turnover rates and higher employee engagement. As a result, facility management providers are adapting their services to include wellness-oriented solutions, which may encompass space planning, health and safety compliance, and the integration of wellness technologies. This trend is likely to continue shaping the market landscape.