Regulatory Framework Enhancements

The electric vehicles market in Japan is experiencing a robust transformation due to the evolving regulatory framework. The government has implemented stringent emissions regulations aimed at reducing greenhouse gas emissions by 46% by 2030. This regulatory push is likely to accelerate the adoption of electric vehicles, as manufacturers are compelled to innovate and produce cleaner alternatives. Furthermore, the introduction of low-emission zones in urban areas is expected to create a favorable environment for electric vehicles, enhancing their market penetration. The regulatory landscape not only encourages manufacturers to invest in electric vehicle technology but also fosters consumer confidence in adopting these vehicles, thereby driving growth in the electric vehicles market.

Corporate Sustainability Commitments

Corporate sustainability commitments are increasingly influencing the electric vehicles market in Japan. Many companies are setting ambitious targets to achieve carbon neutrality by 2050, which necessitates a shift towards electric vehicle fleets. For instance, major corporations are investing heavily in electric vehicle technology and infrastructure to align with their sustainability goals. This trend is likely to create a ripple effect, encouraging smaller businesses to follow suit and adopt electric vehicles as part of their operations. As corporate responsibility becomes a focal point, the electric vehicles market is expected to benefit from increased demand driven by businesses seeking to enhance their environmental credentials.

Infrastructure Development Initiatives

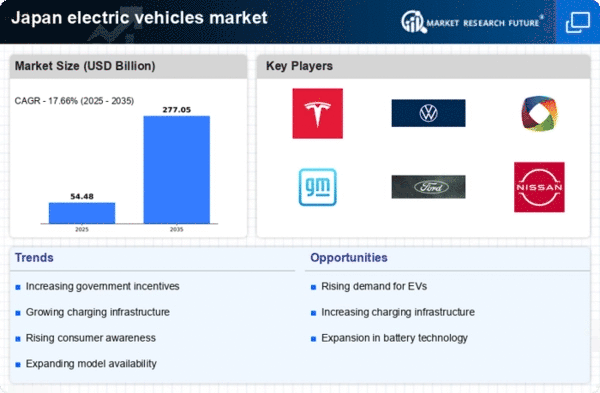

Infrastructure development plays a pivotal role in shaping the electric vehicles market in Japan. The government has committed to expanding the charging network, with a target of installing 150,000 charging stations by 2030. This initiative is crucial, as the availability of charging infrastructure directly influences consumer purchasing decisions. Moreover, the integration of fast-charging stations along major highways is expected to alleviate range anxiety among potential electric vehicle buyers. As the charging infrastructure becomes more accessible, it is anticipated that the electric vehicles market will witness a surge in adoption rates, as consumers feel more secure in their ability to charge their vehicles conveniently.

Rising Fuel Prices and Economic Factors

Rising fuel prices and economic factors are driving a shift towards electric vehicles in Japan. As traditional fuel costs continue to escalate, consumers are increasingly considering electric vehicles as a cost-effective alternative. The total cost of ownership for electric vehicles is becoming more favorable, with lower maintenance and fuel costs compared to internal combustion engine vehicles. Additionally, economic incentives such as tax breaks and subsidies for electric vehicle purchases are further enhancing their appeal. This economic landscape suggests that the electric vehicles market is poised for growth, as consumers seek to mitigate the impact of rising fuel prices on their budgets.

Technological Innovations in Battery Technology

Technological innovations in battery technology are significantly impacting the electric vehicles market in Japan. Advances in lithium-ion batteries, such as increased energy density and reduced charging times, are making electric vehicles more appealing to consumers. The introduction of solid-state batteries, which promise greater safety and efficiency, could further revolutionize the market. As battery technology continues to evolve, it is likely that the cost of electric vehicles will decrease, making them more accessible to a broader audience. This trend suggests that the electric vehicles market will experience accelerated growth as consumers become more attracted to the enhanced performance and affordability of electric vehicles.