Growing Focus on Energy Efficiency

The increasing emphasis on energy efficiency in the automotive sector is a significant driver for the Battery Management System for Electric Vehicles Market. As manufacturers strive to meet stringent energy consumption regulations, the need for effective battery management systems becomes paramount. These systems play a crucial role in optimizing battery usage, extending range, and improving overall vehicle performance. With energy efficiency becoming a key selling point for consumers, the market for battery management systems is expected to grow, potentially reaching a valuation of USD 5 billion by 2027. This trend underscores the importance of integrating advanced battery management solutions to enhance the energy efficiency of electric vehicles, thereby propelling the Battery Management System for Electric Vehicles Market.

Rising Demand for Electric Vehicles

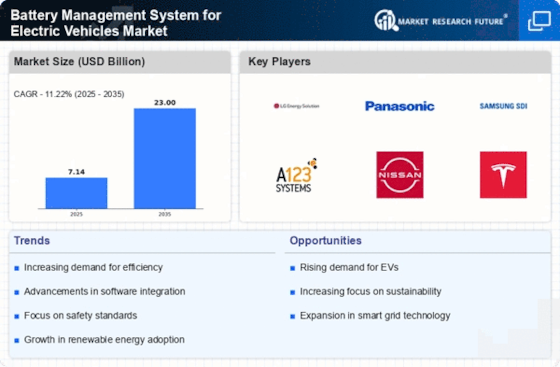

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Battery Management System for Electric Vehicles Market. As environmental concerns gain prominence, more consumers are opting for EVs over traditional internal combustion engine vehicles. This shift is reflected in the sales figures, with EV sales witnessing a substantial rise, accounting for approximately 10% of total vehicle sales in 2025. Consequently, the demand for efficient battery management systems, which ensure optimal performance and longevity of EV batteries, is expected to surge. The Battery Management System for Electric Vehicles Market is thus poised for growth, as manufacturers seek to enhance battery efficiency and safety, aligning with the broader trend of sustainable transportation.

Government Initiatives and Incentives

Government policies and incentives aimed at promoting electric vehicle adoption are pivotal in shaping the Battery Management System for Electric Vehicles Market. Various countries have implemented subsidies, tax rebates, and infrastructure investments to encourage EV purchases. For instance, several regions have set ambitious targets for EV adoption, aiming for 30% of new vehicle sales to be electric by 2030. Such initiatives not only stimulate consumer interest but also compel manufacturers to invest in advanced battery management systems that comply with regulatory standards. The Battery Management System for Electric Vehicles Market is thus likely to benefit from these supportive measures, fostering innovation and enhancing market competitiveness.

Increased Investment in EV Infrastructure

The expansion of electric vehicle infrastructure, including charging stations and battery swapping facilities, is a critical driver for the Battery Management System for Electric Vehicles Market. As more investments pour into EV infrastructure, the convenience and accessibility of electric vehicles improve, leading to higher adoption rates. Reports indicate that the number of public charging stations is projected to double by 2026, facilitating the growth of the EV market. This infrastructure development necessitates advanced battery management systems to ensure efficient charging and battery health monitoring. Consequently, the Battery Management System for Electric Vehicles Market is likely to experience robust growth, driven by the increasing need for reliable and efficient battery management solutions in tandem with expanding EV infrastructure.

Technological Advancements in Battery Technology

Technological innovations in battery technology are significantly influencing the Battery Management System for Electric Vehicles Market. Developments such as solid-state batteries and lithium-sulfur batteries promise higher energy densities and improved safety profiles. These advancements not only enhance the performance of electric vehicles but also necessitate sophisticated battery management systems to monitor and optimize battery health. As battery technology evolves, the market for battery management systems is likely to expand, with an estimated growth rate of 15% annually through 2030. This trend indicates a robust demand for advanced battery management solutions that can adapt to new battery chemistries and configurations, thereby driving the Battery Management System for Electric Vehicles Market forward.