Expansion of E-commerce Platforms

The rapid expansion of e-commerce platforms in Japan is significantly influencing the crm software market. As online shopping continues to gain traction, businesses are increasingly adopting crm solutions to manage customer relationships effectively. The integration of crm software with e-commerce platforms allows for seamless tracking of customer interactions, preferences, and purchase history. This integration is crucial for enhancing customer experience and driving sales. Recent statistics indicate that e-commerce sales in Japan are expected to reach ¥20 trillion by 2025, further emphasizing the need for robust crm systems. Consequently, the crm software market is likely to see increased demand as businesses strive to optimize their online presence and customer engagement strategies.

Growing Importance of Data Analytics

In the crm software market, the growing importance of data analytics is becoming increasingly evident. Organizations in Japan are recognizing the value of data-driven decision-making to enhance customer relationships and operational efficiency. By utilizing advanced analytics tools integrated within crm systems, businesses can gain insights into customer behavior, preferences, and trends. This analytical capability enables companies to tailor their marketing strategies and improve customer service. As a result, The CRM Software Market is projected to witness a surge in demand for analytics-driven solutions.. Recent reports suggest that companies leveraging data analytics in their crm strategies can improve customer retention rates by up to 15%, highlighting the potential benefits of this trend.

Increased Focus on Mobile Accessibility

The CRM Software Market is witnessing an increased focus on mobile accessibility., driven by the growing reliance on mobile devices for business operations. In Japan, professionals are increasingly seeking crm solutions that offer mobile functionality, allowing them to manage customer relationships on-the-go. This trend is particularly relevant as remote work and mobile engagement become more prevalent. Companies are investing in mobile-friendly crm systems that provide real-time access to customer data and communication tools. As of November 2025, it is estimated that over 60% of crm users in Japan utilize mobile applications for their crm needs. This shift towards mobile accessibility is likely to shape the future of the crm software market, as businesses prioritize flexibility and convenience.

Rising Demand for Customer-Centric Solutions

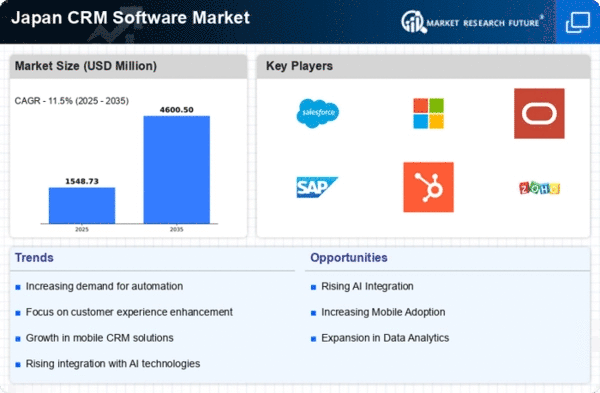

The CRM Software Market in Japan is experiencing a notable shift towards customer-centric solutions. Businesses are increasingly recognizing the importance of understanding customer needs and preferences to enhance engagement and loyalty. This trend is reflected in the growing investment in crm systems that offer personalized experiences. According to recent data, the market is projected to grow at a CAGR of 10.5% from 2025 to 2030, driven by the need for tailored customer interactions. Companies are leveraging crm software to analyze customer data, enabling them to create targeted marketing campaigns and improve service delivery. This focus on customer-centricity is reshaping the crm software market, as organizations seek to differentiate themselves in a competitive landscape.

Emphasis on Integration with Other Business Tools

The crm software market is experiencing a growing emphasis on integration with other business tools. In Japan, organizations are increasingly seeking crm solutions that can seamlessly connect with various applications, such as marketing automation, project management, and customer support systems. This integration is essential for creating a unified view of customer interactions and streamlining workflows. As businesses aim to enhance operational efficiency, the demand for integrated crm solutions is likely to rise. Recent data indicates that companies that utilize integrated crm systems can improve their productivity by up to 20%. This trend underscores the importance of interoperability in the crm software market, as organizations strive to optimize their technology ecosystems.