Enhanced Customer Experience

The Banking CRM Software Market is increasingly driven by the need for enhanced customer experience. Financial institutions are recognizing that personalized services and tailored communication can significantly improve customer satisfaction and loyalty. As a result, banks are investing in CRM solutions that enable them to gather and analyze customer data effectively. This trend is reflected in the projected growth of the CRM software market, which is expected to reach USD 80 billion by 2025. By leveraging CRM tools, banks can streamline their operations, respond to customer inquiries more efficiently, and ultimately foster stronger relationships with their clients.

Regulatory Compliance Demands

Regulatory compliance remains a critical driver in the Banking CRM Software Market. Financial institutions are under increasing pressure to adhere to stringent regulations regarding data protection and customer privacy. CRM software solutions that incorporate compliance features are becoming essential for banks to mitigate risks associated with non-compliance. The market for compliance-focused CRM solutions is expected to grow as institutions seek to avoid hefty fines and reputational damage. As regulations evolve, the demand for CRM systems that can adapt to these changes will likely increase, further propelling the growth of the Banking CRM Software Market.

Shift Towards Omnichannel Banking

The shift towards omnichannel banking is a prominent driver in the Banking CRM Software Market. Customers now expect seamless interactions across various channels, including online, mobile, and in-branch services. This demand compels banks to adopt CRM solutions that provide a unified view of customer interactions, ensuring consistency and continuity. As a result, the omnichannel CRM market is anticipated to grow at a rate of 30% annually. By implementing omnichannel strategies, banks can enhance customer engagement and satisfaction, ultimately leading to increased retention and profitability.

Growing Importance of Data Analytics

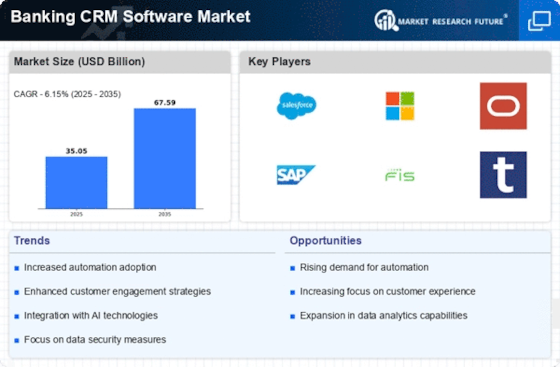

The growing importance of data analytics is reshaping the Banking CRM Software Market. Banks are increasingly recognizing the value of data-driven decision-making, which allows them to identify trends, forecast customer needs, and optimize their marketing strategies. The ability to analyze vast amounts of customer data enables banks to segment their clientele effectively and deliver targeted campaigns. The analytics segment of the CRM market is projected to grow significantly, with an expected increase of 25% by 2026. This trend underscores the necessity for banks to invest in robust CRM solutions that can harness the power of data analytics.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is a key driver in the Banking CRM Software Market. These technologies facilitate the automation of various processes, enabling banks to enhance their operational efficiency. For instance, AI-driven analytics can provide insights into customer behavior, allowing banks to tailor their offerings accordingly. The market for AI in CRM is anticipated to grow at a compound annual growth rate of 34% from 2023 to 2028. This technological evolution not only improves customer engagement but also positions banks to compete more effectively in a rapidly changing financial landscape.