Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the IVD Contract Manufacturing Market, as healthcare organizations strive to reduce expenses while maintaining high-quality standards. Contract manufacturing offers a viable solution by allowing companies to leverage specialized expertise and economies of scale. This approach can lead to significant cost savings in production, which is particularly beneficial for smaller firms that may lack the resources for in-house manufacturing. Recent analyses suggest that outsourcing manufacturing can reduce operational costs by up to 30%, making it an attractive option for many companies. As the pressure to control costs intensifies, the reliance on contract manufacturers is likely to grow, further solidifying their role in the IVD market. This trend underscores the importance of strategic partnerships between diagnostic companies and contract manufacturers to enhance operational efficiency.

Technological Innovations in IVD

Technological advancements are revolutionizing the IVD Contract Manufacturing Market, enabling the development of more sophisticated diagnostic tools. Innovations such as point-of-care testing, microfluidics, and automation are enhancing the efficiency and accuracy of diagnostic processes. For instance, the integration of artificial intelligence in diagnostic devices is streamlining data analysis and improving decision-making. The market for IVD devices is expected to grow at a compound annual growth rate of approximately 6.5% from 2023 to 2028, driven by these technological innovations. As manufacturers adopt cutting-edge technologies, they can offer more reliable and faster testing solutions, which are essential in today’s fast-paced healthcare environment. This trend not only boosts the competitiveness of contract manufacturers but also aligns with the evolving needs of healthcare providers and patients.

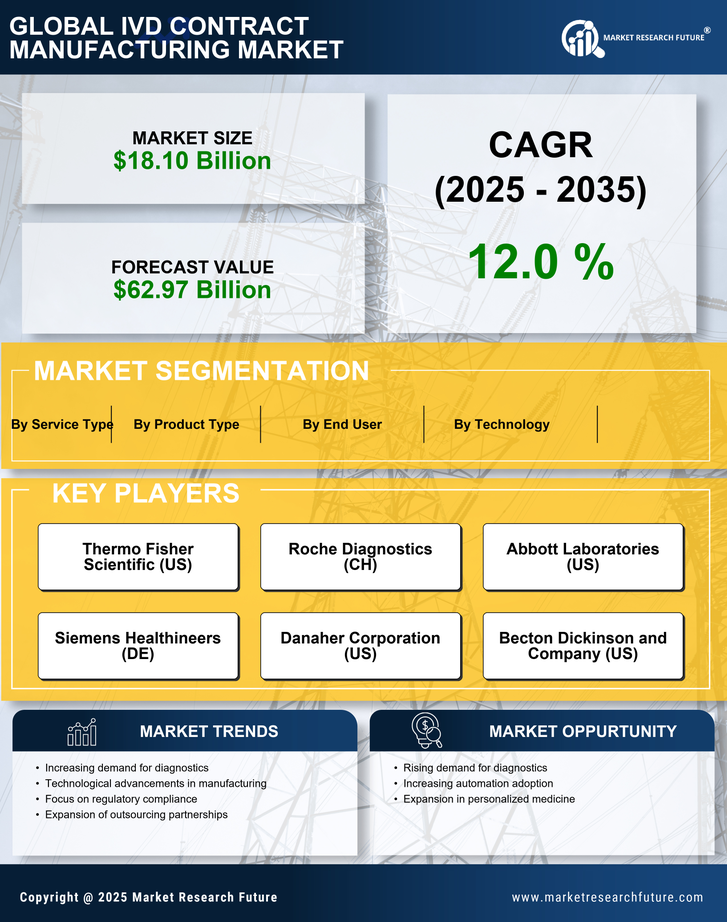

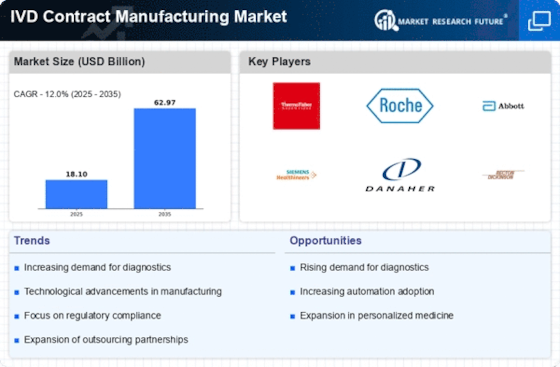

Rising Demand for Diagnostic Testing

The increasing prevalence of chronic diseases and the aging population are driving the demand for diagnostic testing. This trend is particularly evident in the IVD Contract Manufacturing Market, where the need for rapid and accurate diagnostic solutions is paramount. According to recent estimates, the market for in vitro diagnostics is projected to reach USD 100 billion by 2026, indicating a robust growth trajectory. As healthcare providers seek to enhance patient outcomes, the reliance on contract manufacturers to produce high-quality diagnostic products is likely to intensify. This demand is further fueled by the need for personalized medicine, which necessitates advanced diagnostic tools. Consequently, IVD contract manufacturers are positioned to play a crucial role in meeting this escalating demand, thereby shaping the future landscape of the industry.

Regulatory Compliance and Quality Assurance

The IVD Contract Manufacturing Market is increasingly influenced by stringent regulatory requirements and the need for quality assurance. Regulatory bodies are imposing more rigorous standards to ensure the safety and efficacy of diagnostic products. This trend necessitates that contract manufacturers invest in compliance measures and quality control processes. Companies that can demonstrate adherence to these regulations are more likely to gain the trust of healthcare providers and patients alike. The market for regulatory compliance solutions is projected to grow, reflecting the heightened focus on quality in the IVD sector. As manufacturers navigate complex regulatory landscapes, their ability to maintain compliance will be a critical factor in their success. This emphasis on quality assurance not only protects patient safety but also enhances the reputation of the IVD contract manufacturing sector.

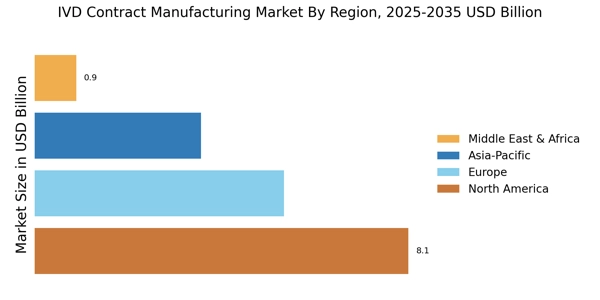

Emerging Markets and Expansion Opportunities

Emerging markets present substantial growth opportunities for the IVD Contract Manufacturing Market. As healthcare infrastructure improves in developing regions, the demand for diagnostic testing is expected to rise significantly. Countries in Asia-Pacific and Latin America are witnessing increased investments in healthcare, which is likely to drive the need for advanced diagnostic solutions. The IVD market in these regions is anticipated to grow at a faster rate compared to more established markets, with a projected CAGR of around 8% over the next five years. This growth is attracting contract manufacturers looking to expand their operations and tap into new customer bases. By establishing a presence in these emerging markets, contract manufacturers can not only diversify their portfolios but also contribute to improving healthcare outcomes in underserved populations.