Growth of Smart Cities

The development of smart cities in Italy is significantly influencing the video surveillance-storage market. As urban areas become more interconnected, the need for comprehensive surveillance systems that can integrate with other smart technologies is becoming apparent. Investments in smart city initiatives are projected to exceed €10 billion by 2027, with a substantial portion allocated to security infrastructure. This trend suggests that the video surveillance-storage market will benefit from increased demand for scalable storage solutions capable of handling the data generated by numerous surveillance devices. Consequently, the market is likely to see a surge in innovative storage technologies to support the evolving needs of smart urban environments.

Rising Security Concerns

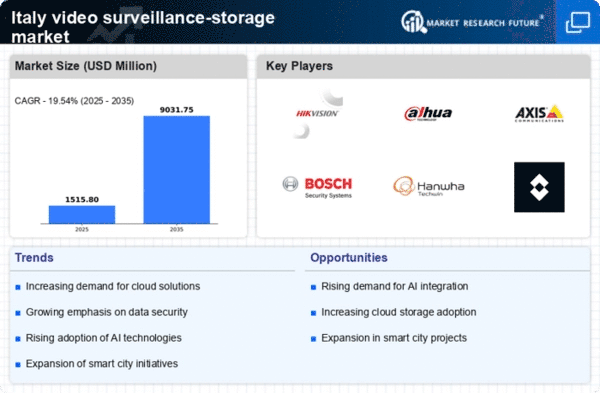

The increasing prevalence of crime and security threats in urban areas of Italy has led to a heightened demand for effective surveillance solutions. As businesses and public institutions seek to protect their assets and ensure safety, the video surveillance-storage market experiences significant growth. In 2025, the market is projected to reach approximately €1.5 billion, reflecting a compound annual growth rate (CAGR) of around 8%. This trend indicates that organizations are investing more in advanced surveillance technologies, which require robust storage solutions to manage the vast amounts of data generated. Consequently, The video surveillance-storage market will expand as stakeholders prioritize security measures.

Integration of AI and Analytics

The integration of artificial intelligence (AI) and advanced analytics into video surveillance systems is transforming the landscape of the video surveillance-storage market. AI technologies enable real-time data processing and intelligent analysis, allowing for more efficient storage and retrieval of video footage. In Italy, the adoption of AI-driven surveillance solutions is expected to increase by 25% over the next five years. This shift not only enhances security capabilities but also optimizes storage requirements, as intelligent systems can prioritize critical data. As a result, the video surveillance-storage market is poised for substantial growth, driven by the demand for smarter, more efficient surveillance solutions.

Demand for Cloud-Based Solutions

The shift towards cloud-based storage solutions is reshaping the video surveillance-storage market in Italy. Organizations are increasingly recognizing the benefits of cloud technology, including scalability, cost-effectiveness, and remote access to surveillance data. By 2026, it is anticipated that cloud-based storage will account for over 40% of the total market share in Italy. This transition allows businesses to reduce the burden of on-premises storage infrastructure while ensuring that video data is securely stored and easily accessible. As a result, the video surveillance-storage market is likely to experience accelerated growth, driven by the demand for flexible and efficient storage options.

Increased Investment in Infrastructure

The Italian government's commitment to enhancing national security infrastructure is a key driver for the video surveillance-storage market. Recent initiatives aimed at improving public safety and security have led to increased funding for surveillance projects across various sectors, including transportation, public spaces, and critical infrastructure. In 2025, public sector investments in surveillance technology are expected to reach €500 million, significantly impacting the market. This influx of capital is likely to stimulate demand for advanced storage solutions that can accommodate the growing volume of surveillance data. Thus, the video surveillance-storage market is positioned for growth as infrastructure investments continue to rise.