Increased Interconnectivity Needs

The submarine power-cable market is experiencing a surge in demand due to the increasing need for interconnectivity among various regions in Italy. As the country aims to enhance its energy security and diversify its energy sources, the deployment of submarine cables becomes essential. These cables facilitate the transfer of electricity between islands and the mainland, thereby improving grid stability. Recent data indicates that interconnections can reduce energy costs by up to 15%, making them a financially viable solution. Furthermore, the Italian government has recognized the importance of these connections, leading to investments in infrastructure that support the submarine power-cable market. This trend is likely to continue as Italy seeks to integrate more renewable energy sources into its grid, further driving the demand for submarine cables.

Growing Demand for Energy Security

The growing demand for energy security in Italy is driving the submarine power-cable market. As the country faces challenges related to energy supply disruptions and fluctuating prices, the need for reliable energy sources becomes paramount. Submarine cables provide a strategic solution by enabling the import of electricity from neighboring countries, thus diversifying energy sources and enhancing resilience. The Italian energy strategy emphasizes the importance of interconnections, with plans to expand existing submarine cable networks. This focus on energy security is likely to propel the submarine power-cable market forward, as stakeholders recognize the value of a robust and interconnected energy infrastructure.

Environmental Sustainability Initiatives

The submarine power-cable market is significantly influenced by Italy's commitment to environmental sustainability. The Italian government has set ambitious targets to reduce greenhouse gas emissions by 55% by 2030, which necessitates a shift towards cleaner energy sources. Submarine cables play a crucial role in this transition by enabling the efficient transmission of renewable energy from offshore wind farms and solar installations to urban centers. The market is projected to grow as investments in renewable energy infrastructure increase, with estimates suggesting that the sector could reach a value of €2 billion by 2027. This focus on sustainability not only aligns with global environmental goals but also enhances Italy's energy independence, thereby bolstering the submarine power-cable market.

Technological Innovations in Cable Design

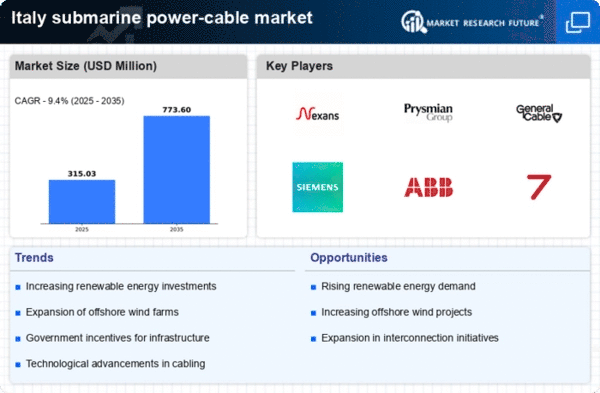

Technological advancements in cable design are reshaping the submarine power-cable market. Innovations such as improved insulation materials and enhanced cable laying techniques are increasing the efficiency and reliability of submarine cables. These developments allow for longer cable lengths and greater transmission capacities, which are essential for meeting Italy's growing energy demands. For instance, the introduction of high-voltage direct current (HVDC) technology has been a game-changer, enabling the transmission of electricity over vast distances with minimal losses. As a result, the market is expected to expand, with projections indicating a compound annual growth rate (CAGR) of 8% over the next five years. This technological evolution not only enhances operational efficiency but also supports Italy's broader energy strategy.

Government Incentives for Infrastructure Development

The submarine power-cable market is benefiting from various government incentives aimed at infrastructure development. The Italian government has launched several initiatives to promote investments in energy infrastructure, including subsidies and tax breaks for projects involving submarine cables. These incentives are designed to attract private investment and accelerate the deployment of necessary infrastructure. Recent reports suggest that public funding for energy projects has increased by 20% in the last year, reflecting a strong commitment to enhancing the submarine power-cable market. This financial support is crucial for overcoming the high initial costs associated with submarine cable projects, thereby facilitating the growth of the market in Italy.