Enhanced Energy Efficiency

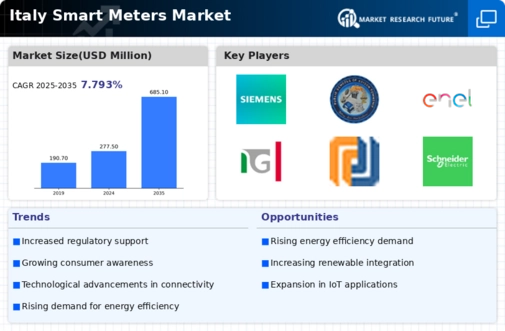

The Italy smart meters market is experiencing a notable shift towards enhanced energy efficiency. Smart meters facilitate real-time monitoring of energy consumption, allowing consumers to adjust their usage patterns accordingly. This capability is particularly relevant in Italy, where energy efficiency regulations have become increasingly stringent. The Italian government has set ambitious targets for reducing energy consumption, which has led to a surge in the adoption of smart meters. According to recent data, the implementation of smart meters is projected to reduce energy consumption by approximately 10% across residential sectors. This trend not only benefits consumers through lower energy bills but also aligns with Italy's broader sustainability goals, thereby driving growth in the smart meters market.

Government Incentives and Policies

The Italy smart meters market is significantly influenced by government incentives and policies aimed at promoting smart grid technologies. The Italian government has introduced various initiatives to encourage the deployment of smart meters, including financial subsidies and tax incentives for both consumers and utility companies. These policies are designed to accelerate the transition to smart metering systems, which are essential for modernizing the energy infrastructure. As of January 2026, it is estimated that over 30 million smart meters have been installed across Italy, supported by these government initiatives. This proactive approach not only enhances energy management but also fosters innovation within the energy sector, thereby propelling the growth of the smart meters market.

Increased Consumer Awareness and Engagement

The Italy smart meters market is experiencing increased consumer awareness and engagement regarding energy consumption. As consumers become more informed about their energy usage, they are more likely to adopt smart metering solutions. Educational campaigns and outreach programs initiated by utility companies have played a crucial role in this trend. Data indicates that consumer interest in smart meters has risen by over 25% in the past year, driven by a desire for greater control over energy costs and environmental impact. This heightened awareness not only encourages the adoption of smart meters but also promotes energy conservation practices, thereby supporting the growth of the smart meters market in Italy.

Rising Demand for Renewable Energy Integration

The Italy smart meters market is witnessing a rising demand for the integration of renewable energy sources. As Italy continues to invest in solar and wind energy, the need for smart meters becomes increasingly critical. These devices enable better management of energy flows from renewable sources, ensuring that excess energy can be efficiently utilized or stored. The Italian government has set a target of achieving 55% of its energy from renewable sources by 2030, which necessitates the deployment of smart metering systems. This integration not only supports the national energy strategy but also enhances grid stability and reliability, thereby driving the growth of the smart meters market.

Technological Advancements in Metering Solutions

The Italy smart meters market is benefiting from rapid technological advancements in metering solutions. Innovations such as advanced data analytics, IoT connectivity, and enhanced cybersecurity measures are transforming the capabilities of smart meters. These technologies allow for more accurate data collection and analysis, enabling utilities to optimize their operations and improve customer service. As of January 2026, the market is seeing a shift towards smart meters that offer two-way communication, which enhances the interaction between consumers and utility providers. This technological evolution not only improves operational efficiency but also fosters consumer trust and engagement, thereby contributing to the overall growth of the smart meters market.