Technological Advancements

Technological advancements play a pivotal role in shaping the Japan smart meters market. Innovations in communication technologies, such as IoT and advanced data analytics, have enabled the development of more efficient and user-friendly smart meters. These devices now offer real-time data on energy consumption, allowing consumers to make informed decisions about their energy usage. The integration of artificial intelligence in smart meters is also emerging, providing predictive analytics that can optimize energy consumption patterns. As of 2025, the market is projected to grow at a compound annual growth rate of approximately 15%, largely due to these technological enhancements that improve the functionality and appeal of smart meters in Japan.

Energy Management Solutions

The growing emphasis on energy management solutions is a significant driver for the Japan smart meters market. With the rise of smart homes and the Internet of Things, consumers are increasingly seeking integrated energy management systems that include smart meters. These solutions allow users to monitor and control their energy usage remotely, leading to enhanced energy efficiency. The market for energy management systems in Japan is projected to reach USD 1 billion by 2026, indicating a robust demand for smart meters as part of these systems. This trend reflects a broader shift towards sustainable living and energy conservation, further solidifying the role of smart meters in the Japan smart meters market.

Consumer Engagement and Awareness

Consumer engagement and awareness are crucial drivers in the Japan smart meters market. As consumers become more conscious of their energy consumption and its environmental impact, the demand for smart meters is likely to increase. Educational campaigns by utility companies and government bodies have been instrumental in informing the public about the benefits of smart meters, such as cost savings and energy efficiency. Surveys indicate that approximately 70% of Japanese consumers are now aware of smart meter technology and its advantages. This heightened awareness is expected to translate into increased adoption rates, further propelling the growth of the Japan smart meters market.

Government Initiatives and Policies

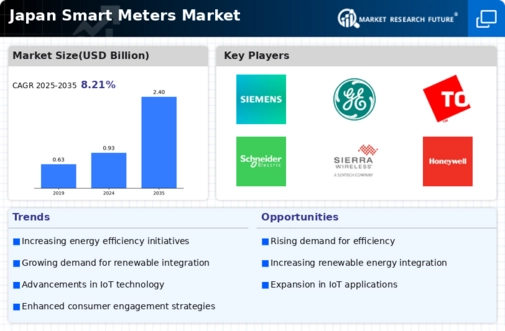

The Japan smart meters market is significantly influenced by government initiatives aimed at enhancing energy efficiency and sustainability. The Japanese government has set ambitious targets for reducing greenhouse gas emissions, which includes the widespread adoption of smart meters. As of 2025, it is estimated that over 80% of households in Japan will have smart meters installed, driven by policies that mandate their deployment. This regulatory framework not only encourages utility companies to invest in smart meter technology but also facilitates the integration of renewable energy sources into the grid. Furthermore, the government has introduced financial incentives for consumers to adopt smart meters, thereby stimulating demand within the Japan smart meters market.

Integration with Renewable Energy Sources

The integration of renewable energy sources into the grid is a critical driver for the Japan smart meters market. As Japan continues to invest in solar and wind energy, the need for smart meters that can effectively manage and monitor these energy sources becomes increasingly apparent. Smart meters facilitate the bidirectional flow of energy, allowing consumers to sell excess energy back to the grid. This capability is particularly relevant as Japan aims to achieve 24% of its energy from renewable sources by 2030. The growing adoption of smart meters is expected to support this transition, making them an essential component of the Japan smart meters market.