Enhanced Energy Efficiency

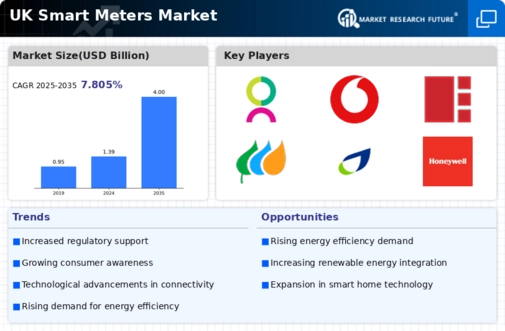

The UK smart meters market is driven by the increasing emphasis on energy efficiency. Smart meters enable consumers to monitor their energy usage in real-time, leading to more informed decisions regarding energy consumption. This heightened awareness can result in reduced energy bills and lower carbon footprints. According to government data, households with smart meters have reported energy savings of up to 10 percent. The UK government has set ambitious targets for reducing greenhouse gas emissions, which further propels the adoption of smart meters as a tool for achieving these goals. As energy efficiency becomes a priority for both consumers and policymakers, the demand for smart meters is likely to grow, reinforcing their role in the UK smart meters market.

Technological Advancements

Technological advancements play a crucial role in shaping the UK smart meters market. Innovations in smart meter technology, such as improved data analytics and enhanced connectivity, are making these devices more efficient and user-friendly. The integration of Internet of Things (IoT) capabilities allows for better communication between smart meters and energy providers, facilitating real-time data exchange. This technological evolution not only enhances the functionality of smart meters but also encourages consumer adoption. As of January 2026, the market is witnessing a shift towards smart meters that can integrate with home automation systems, further driving their appeal. The continuous evolution of technology is expected to bolster the growth of the UK smart meters market.

Consumer Demand for Transparency

Consumer demand for transparency in energy billing and usage is a key driver in the UK smart meters market. As consumers become more conscious of their energy consumption patterns, they seek tools that provide clear insights into their usage. Smart meters offer detailed information about energy consumption, allowing users to track their usage in real-time and understand their energy costs better. This transparency fosters trust between consumers and energy providers, potentially leading to increased customer satisfaction and loyalty. The UK government has recognized this trend and is promoting initiatives that encourage energy suppliers to provide clearer billing information. As consumer expectations evolve, the demand for smart meters is likely to rise, further propelling the growth of the UK smart meters market.

Government Mandates and Policies

The UK smart meters market is significantly influenced by government mandates and policies aimed at promoting smart meter installations. The UK government has established a legally binding target for the rollout of smart meters across all homes and small businesses by 2025. This initiative is part of a broader strategy to modernize the energy system and enhance consumer engagement. The rollout is supported by various funding mechanisms and regulatory frameworks that incentivize energy suppliers to install smart meters. As of January 2026, over 30 million smart and advanced meters have been installed in homes and small businesses, indicating strong progress towards these targets. The ongoing commitment from the government to support this transition is likely to sustain growth in the UK smart meters market.

Rising Demand for Renewable Energy

The increasing demand for renewable energy sources is a significant driver in the UK smart meters market. As more consumers and businesses seek to reduce their reliance on fossil fuels, the integration of renewable energy into the grid becomes essential. Smart meters facilitate this transition by providing real-time data on energy consumption and generation, enabling users to optimize their energy use. The UK government has set ambitious targets for renewable energy generation, aiming for 70 percent of electricity to come from low-carbon sources by 2030. This shift not only supports environmental goals but also enhances the functionality of smart meters, making them indispensable in managing energy flows. The growing emphasis on sustainability is likely to further accelerate the adoption of smart meters in the UK smart meters market.