Aging Population and Healthcare Needs

Italy's demographic shift towards an aging population is a crucial driver for the radiopharmaceuticals market. As the elderly population increases, there is a corresponding rise in the incidence of age-related diseases, such as cancer and cardiovascular disorders. This demographic trend necessitates advanced diagnostic and therapeutic solutions, leading to a higher demand for radiopharmaceuticals. Current statistics indicate that by 2030, nearly 25% of Italy's population will be over 65 years old, further intensifying the need for effective healthcare solutions. Consequently, the Italy radiopharmaceuticals market is poised for growth as healthcare providers adapt to meet the evolving needs of this demographic.

Growing Demand for Diagnostic Imaging

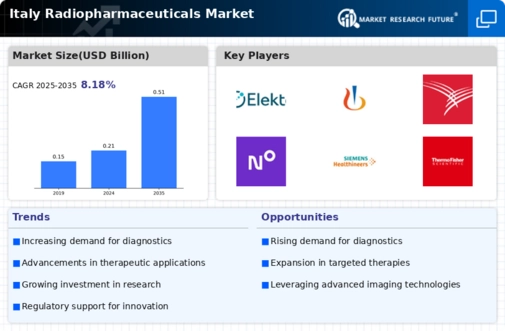

The increasing prevalence of chronic diseases in Italy is driving the demand for advanced diagnostic imaging techniques. The Italy radiopharmaceuticals market is witnessing a surge in the utilization of radiopharmaceuticals for imaging purposes, particularly in oncology and cardiology. According to recent data, the market for diagnostic imaging in Italy is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This growth is attributed to the rising awareness of early disease detection and the need for precise diagnostic tools. As healthcare providers seek to enhance patient outcomes, the integration of radiopharmaceuticals into imaging protocols is becoming more prevalent, thereby bolstering the overall market landscape.

Investment in Research and Development

The Italy radiopharmaceuticals market is significantly benefiting from increased investment in research and development (R&D) activities. Italian pharmaceutical companies and research institutions are focusing on developing novel radiopharmaceuticals that cater to specific medical needs. This trend is supported by government initiatives aimed at fostering innovation in the healthcare sector. For instance, the Italian Ministry of Health has allocated substantial funding for R&D projects related to radiopharmaceuticals, which is expected to enhance the pipeline of new products. The emphasis on R&D not only aims to improve existing therapies but also to explore new applications in personalized medicine, thus expanding the market's potential.

Regulatory Framework Supporting Innovation

The regulatory environment in Italy is increasingly supportive of innovation within the radiopharmaceuticals market. The Italian Medicines Agency (AIFA) has implemented streamlined approval processes for new radiopharmaceuticals, facilitating quicker access to market for innovative products. This regulatory support is crucial for companies looking to introduce novel therapies that can address unmet medical needs. Furthermore, the alignment of Italian regulations with European Union standards enhances the credibility and safety of radiopharmaceuticals, encouraging investment and development in this sector. As a result, the Italy radiopharmaceuticals market is likely to experience accelerated growth due to favorable regulatory conditions.

Collaboration Between Academia and Industry

The collaboration between academic institutions and the pharmaceutical industry is a vital driver for the Italy radiopharmaceuticals market. Universities and research centers in Italy are increasingly partnering with companies to develop cutting-edge radiopharmaceuticals. These collaborations facilitate knowledge transfer and innovation, leading to the creation of new products that meet clinical demands. For example, joint research initiatives have resulted in the development of targeted radiopharmaceuticals that enhance treatment efficacy while minimizing side effects. This synergy not only strengthens the market position of participating entities but also contributes to the overall advancement of the Italy radiopharmaceuticals market.