Advancements in Drone Technology

The integration of advanced drone technology is significantly influencing the photogrammetry software market in Italy. Drones equipped with high-resolution cameras and sensors facilitate the collection of aerial imagery, which is essential for photogrammetric analysis. This technological advancement allows for rapid data acquisition over large areas, making it particularly valuable in sectors such as agriculture, mining, and environmental monitoring. The Italian drone market is expected to grow at a CAGR of around 12% through 2025, indicating a robust potential for photogrammetry software to leverage this growth. As drone technology continues to evolve, the demand for compatible photogrammetry solutions is likely to increase, further propelling market dynamics.

Increased Focus on Heritage Preservation

Italy's rich cultural heritage necessitates the use of photogrammetry software for preservation and restoration projects. The photogrammetry software market is increasingly being employed to create detailed 3D models of historical sites and artifacts, enabling accurate documentation and analysis. This trend is particularly relevant in Italy, where numerous UNESCO World Heritage sites require ongoing conservation efforts. The Italian government has allocated approximately €200 million for cultural heritage initiatives in 2025, which may enhance the adoption of photogrammetry solutions in this domain. As stakeholders recognize the value of digital preservation, the market for photogrammetry software is likely to expand, driven by both public and private investments.

Rising Adoption in Surveying and Mapping

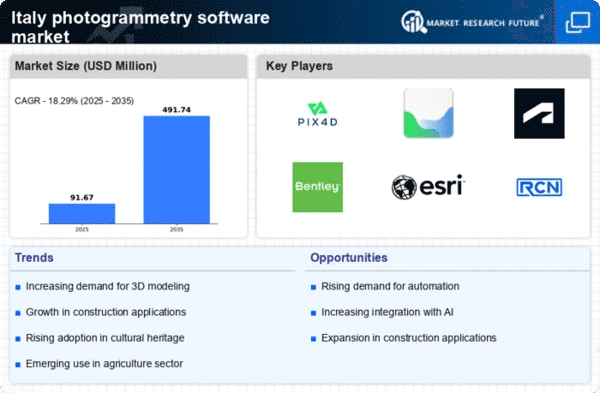

The surveying and mapping sectors in Italy are witnessing a significant shift towards the adoption of photogrammetry software. This transition is largely attributed to the software's ability to provide accurate and efficient data collection methods. Surveyors are increasingly utilizing photogrammetry for topographic mapping, land surveying, and infrastructure monitoring. The photogrammetry software market is projected to grow as professionals seek to enhance their operational capabilities and reduce project timelines. With the Italian surveying market expected to reach €1.5 billion by 2025, the demand for innovative solutions like photogrammetry software is likely to rise, indicating a promising outlook for the industry.

Emergence of Educational and Training Programs

The establishment of educational and training programs focused on photogrammetry is contributing to the growth of the software market in Italy. Universities and technical institutions are increasingly incorporating photogrammetry into their curricula, preparing a new generation of professionals skilled in this technology. This educational emphasis is likely to foster greater awareness and adoption of photogrammetry software across various industries, including architecture, engineering, and environmental science. As of 2025, it is estimated that enrollment in relevant programs will increase by 15%, potentially leading to a more skilled workforce that can effectively utilize photogrammetry solutions. This trend may further stimulate market growth as demand for trained professionals rises.

Growing Demand in Construction and Infrastructure

The construction and infrastructure sectors in Italy are experiencing a notable surge in demand for photogrammetry software. This growth is driven by the need for precise measurements and 3D modeling in urban planning and civil engineering projects. The photogrammetry software market is increasingly utilized for site surveys, enabling professionals to create accurate digital representations of physical spaces. As of 2025, the construction industry in Italy is projected to grow by approximately 4.5%, which is likely to further boost the adoption of photogrammetry solutions. The ability to streamline workflows and enhance project efficiency positions photogrammetry software as a critical tool in these sectors, thereby driving market expansion.