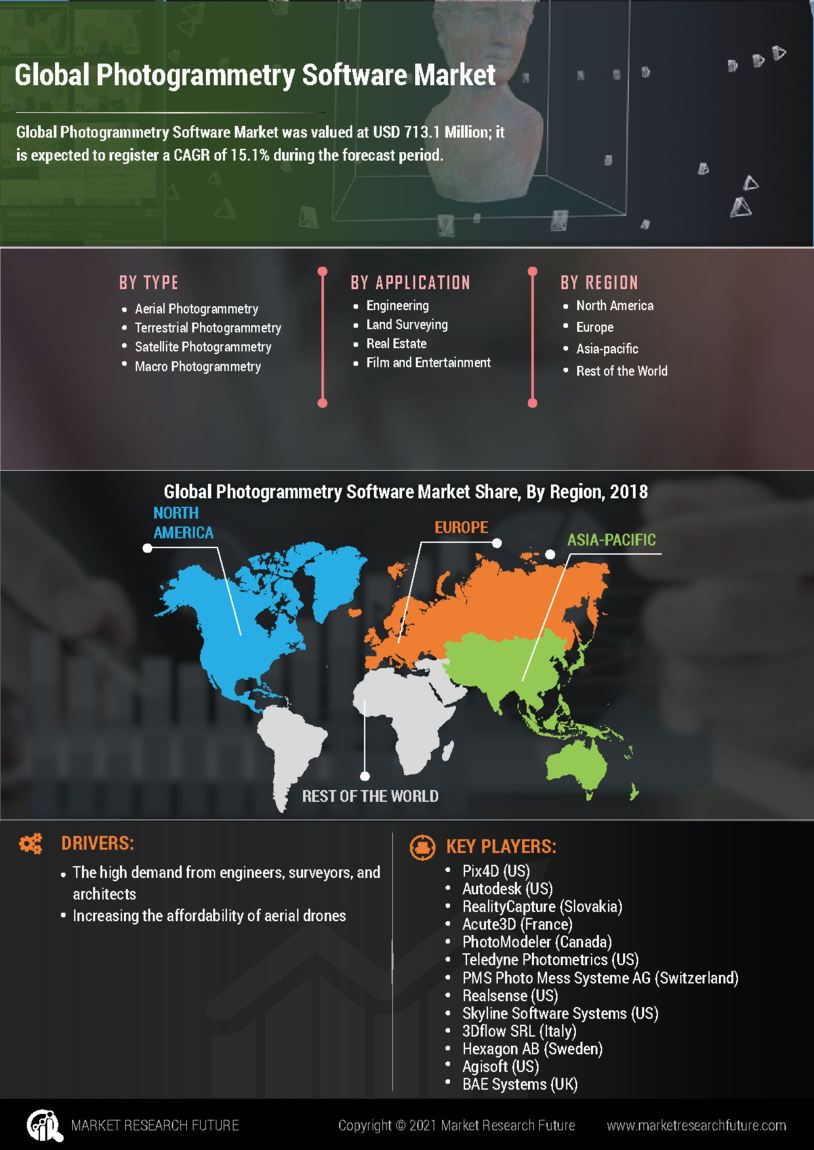

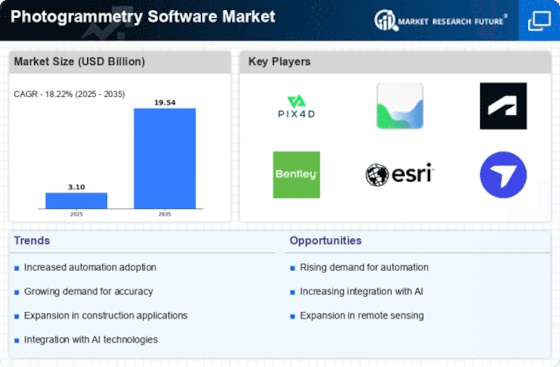

North America : Technological Innovation Leader

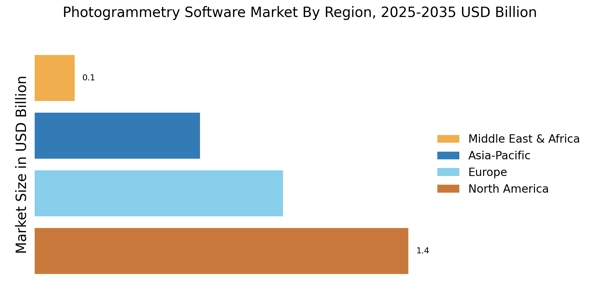

North America is the largest market for photogrammetry software, holding approximately 45% of the global share. The region's growth is driven by advancements in drone technology, increased demand for 3D modeling in construction, and supportive regulations from agencies like the FAA. The integration of photogrammetry in various sectors, including agriculture and urban planning, further fuels this demand.

The United States is the leading country in this market, with key players such as Autodesk, Esri, and DroneDeploy headquartered here. Canada also plays a significant role, with companies like PhotoModeler contributing to the competitive landscape. The presence of these established firms fosters innovation and enhances market growth, making North America a hub for photogrammetry solutions. The Canada photogrammetry software market is expanding steadily, supported by strong adoption in surveying, construction, and geospatial applications.

Europe : Emerging Market with Regulations

Europe is the second-largest market for photogrammetry software, accounting for around 30% of the global share. The region's growth is propelled by stringent regulations promoting the use of drones and 3D mapping technologies in urban planning and environmental monitoring. Countries like Germany and the UK are at the forefront, with increasing investments in infrastructure and smart city initiatives driving demand for photogrammetry solutions. The UK photogrammetry software market is witnessing consistent growth driven by infrastructure development and smart city initiatives. The France photogrammetry software market benefits from increasing investments in urban planning, transportation, and environmental monitoring projects. The Italy photogrammetry software market is supported by strong demand from cultural heritage preservation and architectural restoration projects. The Spain photogrammetry software market is growing due to rising applications in agriculture, infrastructure development, and coastal mapping.

Germany leads the European market, followed closely by the UK and France. Key players such as Pix4D and Bentley Systems are actively expanding their offerings to meet the growing needs of various industries. The competitive landscape is characterized by a mix of established firms and innovative startups, ensuring a dynamic market environment. The European Union's commitment to digital transformation further enhances the region's attractiveness for photogrammetry software.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the photogrammetry software market, holding approximately 20% of the global share. The region's expansion is driven by increasing investments in infrastructure, urbanization, and the adoption of advanced technologies in sectors like agriculture and mining. Countries such as China and Australia are leading this growth, supported by favorable government policies and initiatives promoting digital transformation.

China is the largest market in the region, with significant contributions from companies like 3D Survey and RealityCapture. Australia also plays a vital role, with a growing number of startups entering the market. The competitive landscape is evolving, with both local and international players vying for market share. The increasing demand for accurate mapping and modeling solutions is expected to further boost the region's market potential. The India photogrammetry software market is expanding rapidly, driven by government-led digital mapping programs and infrastructure modernization.

Middle East and Africa : Untapped Potential and Growth

The Middle East and Africa region is gradually emerging in the photogrammetry software market, currently holding about 5% of the global share. The growth is primarily driven by increasing investments in infrastructure projects and the rising adoption of drone technology for surveying and mapping. Countries like the UAE and South Africa are leading this growth, with government initiatives aimed at enhancing technological capabilities in various sectors.

The UAE is at the forefront, with significant projects in urban development and tourism driving demand for photogrammetry solutions. South Africa also shows potential, with a growing interest in agricultural applications. The competitive landscape is still developing, with opportunities for both local and international players to establish a presence in this untapped market. As awareness of photogrammetry benefits increases, the region is poised for substantial growth. The GCC photogrammetry software market is emerging as a high-growth region due to large-scale urban development and smart city projects in the Middle East.